To view in full screen, hover over the upper right corner and click the screen icon

Category Archives: Housing

What’s the Rent? A Snapshot of the Rents for New Affordable Housing in New York City

How Many Rent-Stabilized Apartments Lose Preferential Rents From Year to Year and Does It Affect Tenant Turnover?

Is the New York City Housing Authority’s Participation in Federal Public Housing Repair Programs Lagging?

How Many Apartments in the City’s Public Housing Developments Are Underoccupied?

Which New York City Neighborhoods Saw the Most—and Fewest—Tenants Move from Rent-Stabilized Apartments in 2010-2015?

The city’s diminishing stock of rent-stabilized apartments is highly sought after by prospective tenants because these regulated units often rent at below-market rates and offer a variety of tenant protections including the right to lease renewal. Yet information about the rate at which these apartments turn over tenancies—when the tenant changes from one year to the next—has been lacking. Vacancy rate estimates only capture the number of units empty at a specific point in time and not what became available over the course of a year.

To address this question, IBO examined tenant information for over 925,000 apartments that were rent stabilized for at least two years from 2010 through 2015 to calculate how many apartments turn over from one year to the next and how turnover rates vary by neighborhood. High turnover rates may indicate tenant mobility, changing neighborhood characteristics, or landlord efforts to vacate apartments to increase the legal rent of a rent-stabilized unit—or to reach a rent level that would enable deregulation. In contrast, low turnover rates may indicate tenant stability, or that tenants feel locked in to their rent-stabilized apartments because of their below-market rents when they otherwise may have considered moving.

Average Annual Turnover Rate of Rent-Stabilized

Apartments by Neighborhood, 2010-2015

- Citywide, IBO found the annual turnover rate for rent-stabilized apartments averaged 12 percent over the years 2010-2015.

There was a substantial difference citywide in turnover rates between buildings built prior to 1974 and those built later. The apartments in buildings that were built after 1974 are generally stabilized in exchange for special tax benefits and have rents that tend to be closer to their neighborhood’s market rate. These newer buildings had an average turnover rate of 20 percent citywide while older buildings, in contrast, had an average turnover rate of 11 percent. - Neighborhoods with some of the highest average rates of tenant turnover in rent-stabilized units were Battery Park City-Lower Manhattan (32 percent), New Dorp-Midland Beach on Staten Island (28 percent), and Douglas Manor-Douglaston-Little Neck in Queens (25 percent), although there were few rent-stabilized units in these Staten Island and Queens neighborhoods. Battery Park City-Lower Manhattan has a high share of units built in 1974 or later.

- In neighborhoods with large numbers of pre-1974 rent-stabilized units, those with high average turnover rates include Morningside Heights (17 percent), Astoria (15 percent), and Bay Ridge (also 15 percent), located in Manhattan, Queens, and Brooklyn, respectively.

- Neighborhoods with substantial numbers of pre-1974 rent-stabilized units and low turnover rates include West Concourse in the Bronx, Washington Heights South in Manhattan, and Flatbush in Brooklyn, all with a turnover rate of 9 percent.

SOURCES: IBO analysis of data from New York State Homes and Community Renewal and New York City Department of Finance Real Property Assessment Data

NOTES: A total of 986,807 rent-stabilized units were analyzed from 2010 through 2015, of which 925,116 had at least two years of tenant data to generate a turnover rate. These units reflect apartments that were registered with New York State Homes and Community Renewal (HCR) by their landlords, although analysis indicates that not all stabilized units that should be registered with the state actually are. Years refer to the year in which building owners registered their units with HCR. For each pair of years for which tenancies were compared, IBO determined if an apartment turned over by comparing the names of the primary tenant against the primary tenant for the following year. Names were compared using first and last name combinations to correct for spelling errors and different entry formats across year to year apartment registrations. Neighborhoods are defined by the Department of City Planning Neighborhood Tabulation Areas.

Print version available here.

Prepared by Sarah Stefanski

New York City Independent Budget Office

How Many Homes & Apartments in New York City Sold in Recent Years for More Than $2 Million?

How Does the Condition of the City’s Public Housing Rate Based on the Most Recent Federal Inspections?

How Much Do Yesterday’s 421-a Tax Exemptions Cost Us Today?

When representatives of the real estate industry and construction unions failed to reach an agreement over wages in January, the 421-a tax benefit program came to a halt for the construction of new multifamily housing. This meant the program, which provided property tax exemptions with benefit periods ranging from 10 to 25 years depending on when and where a building was constructed, was no longer available for new projects. But just because the program was suspended does not mean the city is off the hook for previously granted tax breaks. In 2017, the current fiscal year, the city will forego $1.4 billion in property tax revenue due to exemptions granted in prior years—in some instances two decades ago. The last of the properties awarded 421-a benefits before the program’s suspension are not expected to fully return to the property tax roll until 2044.

While state and local policymakers are seeking ways to resuscitate the program or create a new variation, IBO has tracked how long ago the exemptions that result in tax expenditures in a given year were granted.

- The overwhelming majority of 421-a tax expenditures in any given year are for properties that have been awarded benefits in prior years. Since fiscal year 1998, only 16 percent of the total tax expenditure awarded each year on average is attributable to newly exempted properties.

- For the 2017 tax roll, $94.2 million in new 421-a tax expenditures were added, the largest volume increase since 2013 and $14.2 million greater than the 20-year average.

- Of the 2017 tax expenditure, $547.5 million is due to exemptions that started in fiscal years 2007 through 2011, the latter being the year with the most-new exemptions granted (in nominal terms) in the history of the program.

- Buildings that started construction after 2008 are subject to a cap on the amount of value exempted regardless of appreciation. However, for older buildings the value of the exemption can continue to grow as properties appreciate. This results in an increasing share of the tax revenue in recent years coming from exemptions that were granted more than 10 years ago. In recent fiscal years there has also been some shift in the share granted 1 to 5 years earlier to the the share granted 6 to 10 years earlier as the bulge in exemptions granted in 2010 through 2012 age.

Prepared by Geoffrey Propheter

New York City Independent Budget Office

Print version available here.

SOURCE: Department of Finance

| New York City By The Numbers |

How Many Rent-Regulated Units Are Rented at Preferential Rates and Where Are They Located?

It is commonly assumed that rent regulation limits the amount owners can charge tenants, keeping rents below what the market would otherwise command. Yet for thousands of apartments across the city, landlords charge their tenants rents that are lower than the maximum allowed under rent-regulation rules. This is known as a preferential rent. While landlords will sometimes forgo additional permissible rent to retain a reliable tenant, in neighborhoods where there are large shares of tenants paying preferential rents, it is an indication that local market rents are not constrained by rent regulations.

Using apartment registration data from the New York State Division of Housing and Community Renewal, IBO found that of the 765,354 state-registered units subject to the traditional rent-regulation rules in 2013 (the most recent data available), 23 percent—more than 175,000 apartments—were rented at a preferential rate.

Share of Regulated Units Rented at Preferential Rates

Click on a neighborhood to see number of rent-regulated apartments and share with preferential rents.

- Neighborhoods with some of the highest shares of tenants in regulated units paying preferential rates were Oakwood in Staten Island (62 percent), and Fresh Meadows and Bay Terrace in Queens (61 percent and 60 percent, respectively). The overall number of regulated units in these areas, however, was small.

- In neighborhoods with large numbers of regulated units, those with high shares of units receiving preferential rents include Flushing (38 percent), Astoria (35 percent), and Hunters Point-Sunnyside (34 percent).

- Some of the neighborhoods with substantial numbers of regulated units and the lowest shares of apartments with preferential rents include the West Village (10 percent) and the Upper West Side (10 percent). Outside of Manhattan, Borough Park (15 percent) and Prospect-Lefferts Gardens (17 percent) in Brooklyn had low shares of preferential rents.

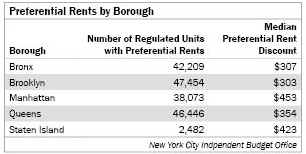

- The prevalence and extent of the rent preference varies among the boroughs. Brooklyn had the largest number of regulated units receiving preferential rents, followed by Queens.

- In terms of the median preferential rent discount—the difference between what the tenant pays and the maximum legal rent the landlord could charge under rent regulation—apartments in Manhattan had the largest median discount, while units in Brooklyn had the smallest.

The fact that in some parts of the city more than a quarter of units receive preferential rents indicates that rent regulation is not always the most important factor in determining a tenant’s rent. Barring substantial increases in market rents in the neighborhoods with large shares of regulated units with preferential rates, continued regulation might not make much difference in determining the cost of housing for tenants in those areas.

Prepared by Sarah Stefanski

New York City Independent Budget Office

SOURCE: IBO analysis of data from the New York State Division of Housing and Community Renewal

NOTES: A total of 862,254 regulated units were registered with the New York State Division of Housing and Community Renewal in 2013, approximately 84 percent of the total estimated number of rent-regulated units in the city. A total of 96,900 units added into rent regulation after 1974 in exchange for certain financing benefits, such as the 421-a and 421-g tax incentive programs, were excluded from this analysis.

Print version available here.

| New York City By The Numbers |