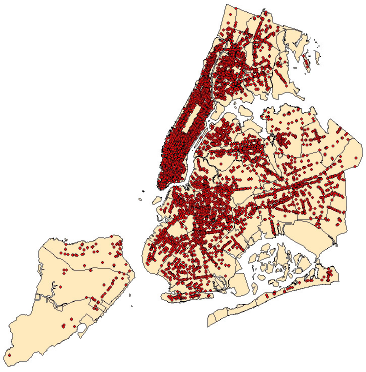

New York City Public Payphones: How Many Are Left?

In January 2013 there were 11,249 working payphones in public locations citywide, a decline of almost

50 percent since 2008.

- The Bronx, Brooklyn, and Staten Island have seen decreases of about 60 percent.

- The number of payphones has fallen 33 percent in Manhattan and 52 percent in Queens.

_______________________________________________________________________

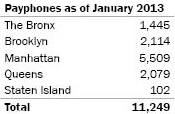

The city collects 10 percent of revenue from calls placed from payphones and 36 percent of revenue from advertisements on the payphones.

- City revenue from calls has declined steadily since 2008.

- City revenue from advertising has increased sharply since 2010.

SOURCE: Department of Information Technology and Telelcommunications

Prepared by Nashla Salas

New York City Independent Budget Office

Print version available here.

| New York City By The Numbers |

How Has the Recent Decline in the Number of Children in Foster Care Affected Costs?

NYC’s Jail Population: Who’s There and Why?

Where Do NYC’s Teachers and Principals Live Compared With Where They Work?

Do Courtroom Delays in the Bronx Come at a Cost to the City?

Suspects arrested on criminal charges who cannot make bail or are denied bail are detained in city jails while their cases are being decided. If the arrestee is convicted and sentenced to time in state prison, the period of time already spent in city jails is deducted from their sentence. Time spent in city jails comes at the city’s expense, time in state prison at the state’s expense. Therefore, the longer it takes to convict, the more it costs the city in detention spending that would otherwise be paid by the state.

The average time in city jails credited to inmates newly sentenced to state prisons from Bronx courtrooms grew to 15.7 months in 2012, about six months more than the average in the remainder of the city. If the average in the Bronx had been the same as that in the rest of the city, New York City would have saved about $14 million last year on jail expenditures.

Print version available here.

Will More Youth Get Jobs in the City’s Summer Jobs Program This Year Than in Recent Summers?

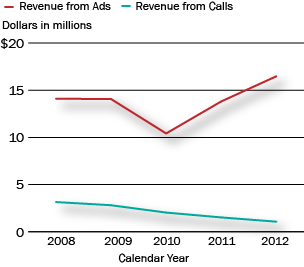

What Type and Size of Buildings Are Receiving 421-a Property Tax Exemptions in 2013?

New York State real property tax law establishes the 421-a property tax exemption for the construction of new multifamily housing in the city. The length of the exemption is 10, 15, 20, or 25 years, which is determined by the location of the new development and whether it includes the construction of affordable housing.

The 421-a exemption is New York City’s most expensive real estate tax break. In 2013, there are 150,000 units of housing receiving 421-a tax exemptions that cost the city $1.1 billion in forgone tax revenue.

PDF version here.

Will New York City Hospitals That Treat Many Low-Income Patients Face The Heaviest Penalties Under New Federal Reimbursement Policies?

Two new federal policies tying Medicare reimbursements to quality of care took effect in October 2012. Hospitals are now penalized for excess readmissions. An additional penalty or bonus can be awarded, based on adherence to clinical standards and ratings on patient surveys.

Hospitals that serve the city’s poor−public hospitals and private safety-net hospitals−generally face heavier penalties than other hospitals. Penalties for 8 out of 12 public hospitals and 4 out of 6 safety-net hospitals exceed the citywide average of 0.97 percent of reimbursements.

Medicare accounts for $777 million of expected inpatient revenues in 2013 at Health & Hospitals Corporation facilities, about 30 percent of all anticipated inpatient revenues, ranging from $21 million at North Central Bronx Hospital to $112 million at Bellevue.

SOURCES: United Hospital Fund; U.S. Centers for Medicare & Medicaid Services

NOTES: Some hospitals have more than one campus, but penalties/bonuses are systemwide. Private safety-net hospitals, as defined by the United Hospital Fund (UHF), are those where Medicaid and uninsured patients comprised more than 50 percent of admissions, other than births, in 2008.

Prepared by Christina Fiorentini

New York City Independent Budget Office

PDF version here.