How Much Does Residence Limit the Types of New York City Traditional Public Schools That People Choose?

As the Number of Students Living in Shelters Has Grown, Has The Increase Been Uniform Among Schools Across the City?

How Has the Distribution of Income in New York City Changed Since 2006?

Which New York City Neighborhoods Saw the Most—and Fewest—Tenants Move from Rent-Stabilized Apartments in 2010-2015?

The city’s diminishing stock of rent-stabilized apartments is highly sought after by prospective tenants because these regulated units often rent at below-market rates and offer a variety of tenant protections including the right to lease renewal. Yet information about the rate at which these apartments turn over tenancies—when the tenant changes from one year to the next—has been lacking. Vacancy rate estimates only capture the number of units empty at a specific point in time and not what became available over the course of a year.

To address this question, IBO examined tenant information for over 925,000 apartments that were rent stabilized for at least two years from 2010 through 2015 to calculate how many apartments turn over from one year to the next and how turnover rates vary by neighborhood. High turnover rates may indicate tenant mobility, changing neighborhood characteristics, or landlord efforts to vacate apartments to increase the legal rent of a rent-stabilized unit—or to reach a rent level that would enable deregulation. In contrast, low turnover rates may indicate tenant stability, or that tenants feel locked in to their rent-stabilized apartments because of their below-market rents when they otherwise may have considered moving.

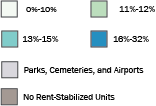

Average Annual Turnover Rate of Rent-Stabilized

Apartments by Neighborhood, 2010-2015

- Citywide, IBO found the annual turnover rate for rent-stabilized apartments averaged 12 percent over the years 2010-2015.

There was a substantial difference citywide in turnover rates between buildings built prior to 1974 and those built later. The apartments in buildings that were built after 1974 are generally stabilized in exchange for special tax benefits and have rents that tend to be closer to their neighborhood’s market rate. These newer buildings had an average turnover rate of 20 percent citywide while older buildings, in contrast, had an average turnover rate of 11 percent. - Neighborhoods with some of the highest average rates of tenant turnover in rent-stabilized units were Battery Park City-Lower Manhattan (32 percent), New Dorp-Midland Beach on Staten Island (28 percent), and Douglas Manor-Douglaston-Little Neck in Queens (25 percent), although there were few rent-stabilized units in these Staten Island and Queens neighborhoods. Battery Park City-Lower Manhattan has a high share of units built in 1974 or later.

- In neighborhoods with large numbers of pre-1974 rent-stabilized units, those with high average turnover rates include Morningside Heights (17 percent), Astoria (15 percent), and Bay Ridge (also 15 percent), located in Manhattan, Queens, and Brooklyn, respectively.

- Neighborhoods with substantial numbers of pre-1974 rent-stabilized units and low turnover rates include West Concourse in the Bronx, Washington Heights South in Manhattan, and Flatbush in Brooklyn, all with a turnover rate of 9 percent.

SOURCES: IBO analysis of data from New York State Homes and Community Renewal and New York City Department of Finance Real Property Assessment Data

NOTES: A total of 986,807 rent-stabilized units were analyzed from 2010 through 2015, of which 925,116 had at least two years of tenant data to generate a turnover rate. These units reflect apartments that were registered with New York State Homes and Community Renewal (HCR) by their landlords, although analysis indicates that not all stabilized units that should be registered with the state actually are. Years refer to the year in which building owners registered their units with HCR. For each pair of years for which tenancies were compared, IBO determined if an apartment turned over by comparing the names of the primary tenant against the primary tenant for the following year. Names were compared using first and last name combinations to correct for spelling errors and different entry formats across year to year apartment registrations. Neighborhoods are defined by the Department of City Planning Neighborhood Tabulation Areas.

Print version available here.

Prepared by Sarah Stefanski

New York City Independent Budget Office

How Many Homes & Apartments in New York City Sold in Recent Years for More Than $2 Million?

How Does the Condition of the City’s Public Housing Rate Based on the Most Recent Federal Inspections?

With Sexually Transmitted Disease Cases Rising in New York City, What Happened to Spending on Treatment and Prevention?

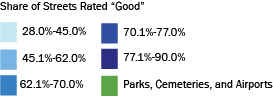

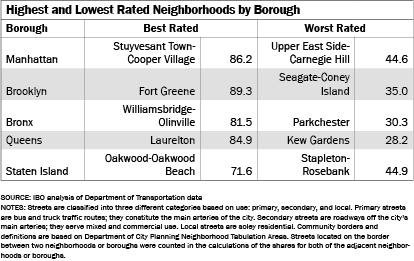

Good, Fair, or Poor: What’s the Condition of the City’s Streets?

The Department of Transportation repairs and maintains the city’s streets. To fulfill this task, the department performs an ongoing street quality assessment and rates sections of every street in the city on an 18-month rolling basis on a scale from 1 to 10. Ratings are categorized into “poor” (1-3), “fair” (4-7), and “good” (8-10), with the exception of local streets for which a rating of 7 is deemed “good.”

Neighborhood Street Ratings with Borough and Citywide Rankings

- Based on ratings from 2014 and 2015 and weighted by their square feet, 70.2 percent of the city’s streets are in good condition, 29.2 percent are in fair condition, and 0.6 percent are in poor condition. Street conditions citywide have trended downward somewhat since 2012, according to the Mayor’s Management Report.

- Brooklyn streets are in the best shape with 75.1 percent of its streets rated as good, followed by Queens with 71.0 percent and the Bronx with 68.5 percent. Manhattan and Staten Island are the boroughs with the fewest streets in good shape—only 66.3 percent and 59.6 percent, respectively.

- Citywide, the neighborhoods with the best ratings are Fort Greene (89.3 percent good), Starrett City (86.5 percent), and Williamsburg (86.3 percent), all of which are located in Brooklyn. The neighborhoods with the worst street quality are Kew Gardens in Queens (28.2 percent good), Parkchester in the Bronx (30.3 percent), and Seagate-Coney Island in Brooklyn (35.0 percent).

Prepared by Giovanella Quintanilla Re

New York City Independent Budget Office

Print version available here.

| New York City By The Numbers |