New York State real property tax law establishes the 421-a property tax exemption for the construction of new multifamily housing in the city. The length of the exemption is 10, 15, 20, or 25 years, which is determined by the location of the new development and whether it includes the construction of affordable housing.

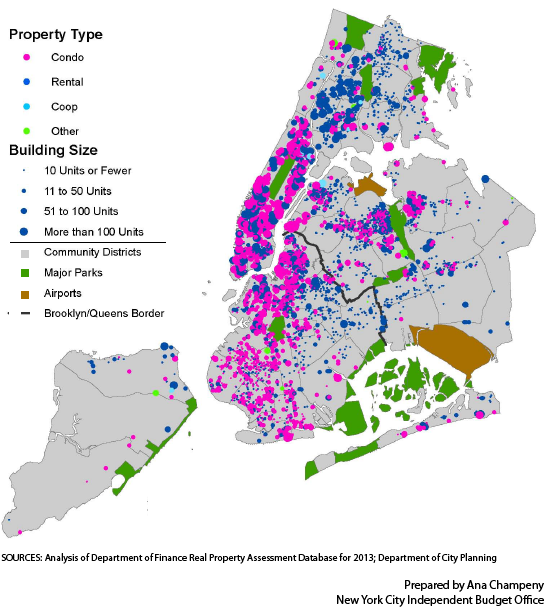

The 421-a exemption is New York City’s most expensive real estate tax break. In 2013, there are 150,000 units of housing receiving 421-a tax exemptions that cost the city $1.1 billion in forgone tax revenue.

PDF version here.