January 2018

The Stuyvesant Town-Peter Cooper Village Deal:

How Much Affordable Housing Did the City Really Preserve?

PDF version available here.

Summary

Over the past decade, near-bankruptcy and efforts to deregulate rent-stabilized apartments at Stuyvesant Town-Peter Cooper Village have left many tenants of the twin complexes uneasy. When the mostly middle-income developments with more than 11,000 apartments were about to be sold in 2015, the de Blasio Administration negotiated a deal it said would keep 5,000 units affordable for 20 years—apartments that the Mayor’s office contended would otherwise have become market rate housing—in exchange for $220 million in city subsidies.

While the de Blasio Administration counts all 5,000 apartments towards its goal of preserving 180,000 affordable units through 2026, to estimate the true effect of the deal the benefits provided to tenants must be weighed against what would have happened without it. The duration of benefits must also be taken into account, particularly because not every apartment will receive the same protections for the same amount of time under the agreement. Accordingly, we examined the agreement in terms of “apartment-years;” the de Blasio Administration’s contention that 5,000 units would be preserved as affordable for 20 years translates into 100,000 apartment-years of affordability. Among our findings:

- IBO estimates that 64,000 of the apartment-years of affordability the de Blasio Administration attributes to the agreement would have remained rent stabilized even without the deal. In other words, the deal can be credited with 36,000 apartment-years of additional affordability—not 100,000.

- Only about 3 percent of the 100,000 apartment-years covered by the agreement will be reserved for low-income households. Twenty-seven percent of the 100,000 apartment-years will be targeted to middle-income households. The remaining 6 percent of apartment-years of affordability consists of units that will remain rent-stabilized longer than they would have absent the agreement. These units will not become income-tested because they never turn over tenancy during the regulatory period.

- The agreement includes an intricate set of rules but has limited oversight and reporting requirements for Blackstone Property Advisors and Ivanhoé Cambridge, the new owners of the complexes.

The October 2015 agreement was the single largest housing preservation deal done by the city. In addition to the $220 million in tax breaks and loans that do not have to be repaid, the de Blasio Administration agreed to support the transfer of air rights from Stuyvesant Town-Peter Cooper Village to other properties. While not a cost to the city, from the perspective of the complexes’ owners, sales of air rights could become the most lucrative part of the deal.

Introduction

When the de Blasio Administration announced a deal to preserve affordable housing at the Stuyvesant Town-Peter Cooper Village development in October of 2015, the number of units it claimed to have preserved was unprecedented for a single transaction. By signing a 20-year regulatory agreement, the Mayor announced he had guaranteed the long-term affordability of 5,000 units of below-market housing at one of the city’s largest rent-stabilized housing complexes. According to the de Blasio Administration, absent the agreement, virtually all of the units in the complex would have eventually converted to market rate status.

Mayor de Blasio has made the preservation of affordable housing—extending the affordability requirements of existing affordable housing before they expire, or entering into new agreements to ensure affordability, in exchange for financing benefits and tax breaks—a key component of his housing plan. The Mayor recently announced an increase to his housing goal, now calling for the preservation of 180,000 affordable units along with the construction of 120,000 new affordable units by 2026. The Stuyvesant Town-Peter Cooper Village preservation deal was widely regarded as a critical step towards meeting this goal.

How many units were preserved by the agreement in exchange for the city’s estimated $220 million investment in Stuyvesant Town-Peter Cooper Village largely depends on what would have happened without the regulatory agreement. Just over 5,000 of Stuyvesant Town-Peter Cooper Village’s more than 11,000 apartments were already renting at below-market rates due to rent stabilization when the deal was reached. Under the agreement, these roughly 5,000 households will remain in their apartments with rent-stabilization laws dictating their rents until they move out. Only when these tenants—those who are already paying the lowest rents in the complex—move out are they replaced by income-tested tenants paying affordable rents, meaning that rents that are based on the income of the new tenants.

Although the city counted all 5,000 units covered by the preservation agreement towards its affordable housing plan’s goal, in order to estimate true impact of this deal, the benefits afforded to tenants through the city’s intervention must be weighed against what would have happened without it, while also accounting for how long these benefits last. As the Independent Budget Office explores in this brief, the Stuyvesant Town-Peter Cooper Village preservation deal can benefit tenants in two ways. First, it can keep some tenants in below-market, rent-stabilized apartments longer than they would have stayed without the agreement. Second it creates income-tested affordable housing, which differs from rent-stabilized housing because apartments are income-restricted and rents are based on the new tenants’ incomes.

In this report, we use New York State Homes and Community Renewal (HCR) data on rent-stabilized units within Stuyvesant Town-Peter Cooper Village from 2004 through 2015 to estimate the magnitude of the benefits the city might actually receive in terms of income-tested affordable housing, as well as extended rent-stabilization protections, over the 20-year period of the regulatory agreement.

First, we model the deregulation of rent-stabilized units over the next 20 years absent the agreement to serve as a baseline for comparison. We then examine how the rules established in the agreement to create income-tested affordable housing interact with the existing rules of rent stabilization. This allows us to estimate how much of the complex’s current rent-stabilized housing is likely to keep protections it otherwise would have lost absent the city’s agreement, as well as how much income-tested affordable housing is likely to be created due to the city’s agreement. Lastly, we consider how existing preferential rent rules may weaken the benefits extended to an additional subset of rent-stabilized units included in the regulatory agreement (although not counted towards the Mayor’s goal), as well as the difficulties the city may have in enforcing the agreement.

| Rent Stabilized Apartments Are Not Necessarily Affordable Housing

The announcement of the Stuyvesant Town-Peter Cooper Village regulatory agreement—as often happens in discussions about New York City housing—conflated rent-stabilized housing with income-tested affordable housing. While rent-stabilized apartments may rent at below-market rates, they are not necessarily synonymous with affordable housing.

Affordable rental housing, as defined in the Mayor’s housing plan, links rents to household incomes. Units are reserved for a specific income tier (such as low, moderate, or middle income), with tiers defined as a percentage of the area median income (AMI) set by the U.S. Department of Housing and Urban Development. Households are income tested to determine whether they fall within the income tier for which a unit is designated. Rents are then set at 30 percent of either a household’s income or the maximum household income allowed for that income tier, depending on how the affordability program is set up, to ensure that tenants are paying a rent considered affordable for them. Affordability protections last for the length of the regulatory agreement established between the building owner and the city, at which point a new regulatory agreement may be signed to extend the affordability period, or units convert to market rate. In contrast, rent stabilization sets a maximum for what a landlord may charge for a specific unit and also limits annual rent increases. Although rents may be below-market and tenants have protections such as a right to a lease renewal, rent stabilization does not require any income testing of households and does not tie rents to household income. Therefore, tenants in rent-stabilized housing may have incomes well above the affordable housing income restrictions set in the Mayor’s housing plan. Conversely, a rent-stabilized tenant whose income does fall within affordable housing income limits may be paying much more than 30 percent of their income in rent, making even a rent-stabilized apartment unaffordable by that standard.1 A unit remains rent stabilized as long as the existing tenant remains in place and the rent remains below a deregulation threshold determined by state law. If a tenant vacates their apartment, the landlord is entitled to a vacancy rent increase on a new lease—greater than the permissible annual renewal lease rent increase—along with an increase allowed for apartment renovations, which makes it more likely that a unit’s rent will exceed the deregulation threshold and therefore shift from rent stabilization to market rate. Similarly, if a tenant’s annual income exceeds a defined threshold for two consecutive years, the unit can be deregulated if the landlord pursues an action with the state’s housing agency. Finally, it is important to note that provisions of certain programs, such as those associated with some tax breaks, may keep units in rent stabilization even if the unit’s rent eventually exceeds the threshold. Despite the fact that the two programs are very different, in this brief, IBO considers the preservation of both rent-stabilized housing that would have converted to market rate without city intervention and the creation income-tested affordable housing as benefits to city tenants. |

Background

Stuyvesant Town-Peter Cooper Village is a large residential complex covering over 80 acres in Manhattan, bounded by 1st Avenue and Avenue C between East 14th Street and East 23rd Street. As the name suggests, the housing development is made up of two components, Stuyvesant Town and Peter Cooper Village—8,746 units and 2,481 units respectively—for a total of 11,227 rentable units contained within 110 buildings. Apartments range in size from one to five bedrooms. It was developed by the Metropolitan Life Insurance Company (MetLife) in conjunction with the city from 1945 through 1947 to address the city’s housing shortage at the conclusion of World War II. Built as an urban renewal project, the city used eminent domain to clear out the more than 12,000 existing residents who lived in the area, then known as the Gas House District.

Although originally built to house families with young children, the present demographics show that the majority of units in Stuyvesant Town-Peter Cooper Village are rented by either individuals or unrelated adults. According to the U.S. Census Bureau 2011-2015 American Community Survey (ACS) five-year estimates, only 12 percent of households include a child under age 18, notably lower than the citywide average of 30 percent. In contrast, 44 percent of all households in the development consist of an individual living alone (compared with 33 percent citywide), and 20 percent of households are comprised of unrelated adults, such as unmarried couples or roommates. Citywide, only 8 percent of households are comprised of unrelated adults.

The population in Stuyvesant Town-Peter Cooper Village is aging, with 28 percent of all households including a resident age 65 or older, according to census data. Citywide, 25 percent of households include a resident age 65 or older. While not an official designation, the development may be considered an example of a naturally occurring retirement community, colloquially referred to as NORCs. Not intentionally built to be senior housing, NORCs are buildings or neighborhoods that naturally evolve as existing populations age in place.

Stuyvesant Town-Peter Cooper Village was constructed by MetLife to serve as middle-class housing, and to that end, many households currently residing in the development have incomes that fall within the Mayor’s housing plan definition of middle income, 165 percent of the area median income (AMI). Analysis of Census data shows that the average household size in the complex is two individuals, and the median income of residents in Stuyvesant Town is $93,010 and Peter Cooper Village is $106,310. Under the preservation regulatory agreement, middle-income units are reserved for a household of two making up to $119,625 in 2016.

City Aims to Protect Tenants After Contentious Sale. MetLife owned the property from its opening in 1947 through 2006. With the real estate market booming, MetLife sold the complex in October 2006 at a record-breaking sale price of $5.4 billion to Tishman Speyer and BlackRock. The new owners intensified a practice started by MetLife in the early 2000s—increasing turnover rates of regulated units in order to remove units from rent stabilization and convert them to market rate. By doing so, the goal of the owners was to substantially increase rental income from the property, increases that Tishman Speyer and BlackRock assumed when they bid on the property. Despite reportedly aggressive tactics to turn over and deregulate units to increase rent rolls, Tishman Speyer and BlackRock were unable to meet their debt obligations and defaulted on the mortgage payments for Stuyvesant Town-Peter Cooper Village in January 2010.2 Fallout from the Great Recession and a court decision that altered assumptions about the potential for deregulating units helped bring on the default. The property was handed over to a special servicer—CWCapital—in an effort to avoid bankruptcy.

CWCapital maintained ownership of Stuyvesant Town-Peter Cooper Village through October 2015. As CWCapital’s responsibility was to protect the interests of the debt holders, they continued with some efforts to increase the rent rolls. These efforts were less aggressive, however, than those of the previous owners, at least in part because they were limited by a court decision. In October 2015, the special servicer agreed to sell Stuyvesant Town-Peter Cooper Village to Blackstone Property Advisers and Ivanhoé Cambridge. Unlike the 2006 sale, in which the city was not involved, with this sale the city intervened with the intention of protecting rent-regulated tenants and the future affordability of the property. As the sale was pending, the city negotiated a regulatory agreement aimed at preserving 5,000 units within Stuyvesant Town-Peter Cooper Village as affordable housing for middle- and low-income households. In a press release, Mayor de Blasio stated that under the regulatory agreement, “5,000 apartments that are at risk of losing their affordability will be locked into a 20-year affordability program … [units that] have been in danger of becoming permanently deregulated as soon as current tenants leave.”3

Subsidies of $220 Million for Regulatory Agreement. In negotiating the regulatory agreement, the city provided the new owners, Blackstone and Ivanhoé Cambridge, with a number of incentives. First, the city waived the mortgage recording tax for the sale, an incentive IBO values at $76 million. Second, the city provided the buyers with a $144 million loan through the Housing Assistance Corporation, a subsidiary of the Housing Development Corporation (HDC), to cover the cost of the real property transfer tax due on the sale. The loan was then passed on to CWCapital, which actually pays the tax, in return for a reduced purchase price. In practice, however, the loan acts as a grant because it is interest free and will be forgiven in annual increments over a 20-year period.

In addition to these direct expenditures, as part of the deal, the de Blasio Administration also stated in the term sheet that the city “agrees to support” the new owner’s “efforts to transfer unused development rights from the [Stuyvesant Town-Peter Cooper Village] property to appropriate receiving area(s) subject to all legally required reviews.”4 When a building has less bulk (square footage) than is allowed under zoning rules, the building can convert some or all of that unused zoning capacity into what is known as transferrable development rights, commonly referred to as “air rights.” Air rights can be sold and transferred to nearby parcels, allowing those receiving lots to be developed with more bulk than would otherwise be allowable under zoning rules. Air rights transfers are generally restricted to lots within the same block, and not allowed to cross streets unless the city has designated the area as a special purpose district to achieve city planning goals, or if the air rights are generated from a landmarked building.5

Stuyvesant Town-Peter Cooper Village is neither in a special purpose district nor is it a landmarked property. The development is underbuilt relative to its zoning, thereby generating these air rights, yet the development encompasses its own city blocks, rendering the air rights unusable under current rules. The city could create a special rule for the property or designate the area a special purpose district, providing a mechanism to render the Stuyvesant Town-Peter Cooper Village air rights usable. No details or commitments regarding air rights are delineated in the regulatory agreement, however, and the value of such air rights depends heavily on when such a transfer would be authorized and where an agreement would allow them to be transferred.

Current Status of Rent Stabilization in Stuyvesant Town-Peter Cooper Village

In order to gauge the impact of the regulatory agreement signed between HDC and the new owners of Stuyvesant Town-Peter Cooper Village, it is necessary to understand the current rent-stabilization status of apartments within the development, a particularly complex issue in this specific development.

All Units in the Complex Are Currently Rent Stabilized. Because Stuyvesant Town-Peter Cooper Village was built in the mid-1940s, all of its units were included in the state’s rent-stabilization system when the Emergency Tenant Protection Act took effect in 1974. Nearly two decades later, starting in 1992, the development began receiving property tax benefits through the J-51 program, which provides property tax relief for rental buildings that undergo renovations and improvements. In exchange for the J-51 tax benefits, all units in a building receiving J-51 are subject to rent stabilization. As Stuyvesant Town-Peter Cooper Village newly began receiving J-51 benefits, New York State passed the Rent Regulation Reform Act of 1993, which spelled out two ways in which rent-stabilized units could be deregulated when the legal rent exceeded $2,000: either when a unit became vacant (known as vacancy deregulation) or where an existing tenant’s income was greater than $250,000 for two consecutive years (known as luxury deregulation). Both the $2,000 legal rent threshold and the high-income threshold have been modified several times since 1993. Although the complex was benefitting from J-51, MetLife (and later Tishman Speyer) began deregulating units under state rules.

In 2007, tenants filed a class action lawsuit against the owners, citing wrongful deregulation practices due to the complex’s receipt of J-51 benefits. In 2009 the Court of Appeals found in Roberts et al. v. Tishman Speyer Properties that rent-stabilized units within J-51 buildings could not be deregulated under the Rent Regulation Reform Act while the building was still enjoying the benefits of J-51. The Roberts decision, as it became known, established that all units must remain rent stabilized so long as the building received J-51, even if units meet the criteria to deregulate. Nearly two years later in 2011, after the parties involved in the lawsuit settled on a formula to recalculate the restabilized rents, the deregulated units were reregistered with New York State Homes and Community Renewal, the state agency that administers the city’s rent regulation system.

Rent-Stabilized Units: Traditional and Roberts. The Roberts decision created two groups of rent-stabilized units within Stuyvesant Town-Peter Cooper Village—traditionally rent-stabilized units and so-called Roberts units. Traditionally rent-stabilized units refer to units that would be rent regulated regardless of whether the complex was receiving J-51 because they have never met the rent or income thresholds necessary to deregulate. In contrast, Roberts units have met the thresholds to deregulate and only remain in rent stabilization because the complex continues to receive J-51; the current J-51 benefit is scheduled to expire in 2020. Absent J-51, Roberts units would be eligible for deregulation and would not be subject to any rent-stabilization rules.

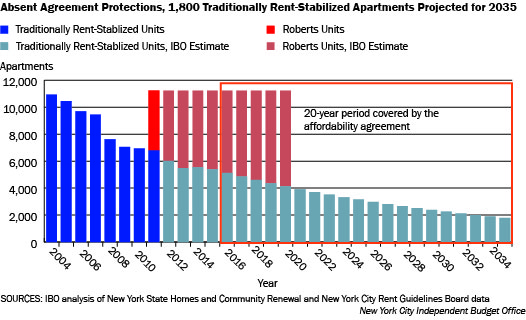

In 2004, the first year for which IBO has rent stabilization data, there were 10,913 traditionally rent-stabilized Stuyvesant Town-Peter Cooper Village apartments registered with New York State Homes and Community Renewal. Based on the rental history of these units, IBO estimates that there were just under 5,400 traditionally rent-stabilized units in Stuyvesant Town-Peter Cooper Village in 2015, with a median legal rent of $1,700.

In 2011, as a result of the legal settlement, 4,331 Roberts units were added back into rent stabilization. The number of Roberts units has increased since 2011, as more units would have been eligible to exit traditional rent stabilization under vacancy or luxury deregulation, but remain rent stabilized because the complex is still benefiting from J-51. IBO estimates that there were about 5,800 Roberts units in 2015. Since the development is still receiving J-51 benefits, these units cannot be deregulated and therefore the usual deregulation thresholds do not apply. The legal rent—the maximum rent a landlord is allowed to charge under rent stabilization—for Roberts units that were returned to rent stabilization after previously being deregulated were generally set higher than the level at which the units exited rent regulation.6 Roberts units generally rent at prices that are closer to market rates. In 2015, the median legal rent of a Roberts unit was $4,800. Over 80 percent of these units, however, rented at a preferential rate with a median actual rent paid by tenants of $3,500. (See sidebar “Terms Used in This Analysis” for more information on preferential rents.) Like traditionally rent-stabilized units, Roberts units enjoy the lease renewal and rent increase protections offered by rent stabilization, but unlike traditionally rent-stabilized units, the rents of Roberts units generally are not lower than market rate.

| Terms Used in This Analysis

Legal rent: The maximum rent a landlord is allowed to charge for a rent-stabilized apartment. The legal rent may increase in line with rates set annually by the Rent Guidelines Board for lease renewals. Legal rents can also increase when rent-stabilized apartments become vacant or when physical improvements are made, or both. Preferential rent: The actual rent paid by a tenant in a rent-stabilized apartment that is lower than the legal rent a landlord may charge. Although in some cases preferential rents are provided to tenants for noneconomic reasons (such as a favor to a personal friend), there are instances—as is seen in Stuyvesant Town-Peter Cooper Village—where the legal rent for the apartment is higher than what the apartment would rent for on the open market, so a preferential rent is provided to the tenant at the market rate. When a lease is renewed, a landlord is allowed to increase a preferential rent by any amount up to an apartment’s legal rent. As a result, increases in preferential rents can exceed the permissible percentage increases set by the Rent Guide Lines Board. Roberts unit: Any Stuyvesant Town-Peter Cooper Village unit that is only in rent stabilization because the property is receiving the J-51 property tax break. While the property is receiving J-51 tax benefits, these apartments may not be deregulated. Upon expiration of J-51 benefits in 2020, these units may be removed from rent stabilization under the standard rules for deregulation. Designated Roberts unit: Any apartment that was deregulated and then later returned to rent stabilization through the settlement of Roberts v. Tishman Speyer Properties, as long as the tenant when the unit reentered rent stabilization in 2011 remains the tenant through the expiration of the J-51 tax benefit in 2020. Upon expiration of the J-51 benefit, rents for designated Roberts units can rise by no more than 5 percent a year for the next five years; once the J-51 benefit expires designated Roberts units may be deregulated if general rent regulation rules permit. Traditionally rent-stabilized unit: Any Stuyvesant Town-Peter Cooper Village unit that would be rent stabilized regardless of the Roberts v. Tishman Speyer Properties decision because the rent has not yet reached the level at which the unit could be deregulated. Initial affordable units: Term used in the Stuyvesant Town-Peter Cooper Village regulatory agreement to describe apartments designated as affordable under the agreement when it was signed in December 2015. Apartments remain initial affordable units until the tenant in place when the agreement was signed in December 2015 moves out of the apartment. Future affordable units: Term used in the Stuyvesant Town-Peter Cooper Village regulatory agreement to describe affordable apartments that have turned over tenancy since the agreement took effect. New tenants for these units have to meet specific restrictions on income and their rents may be capped if the legal rent under rent stabilization exceeds the level deemed affordable to low- and middle-income households or after 2020, if the unit is deregulated and is no longer subject to rent stabilization. Vacancy deregulation: When a traditionally rent-stabilized unit becomes vacant and the legal rent, including the vacancy allowance plus increases allowed for apartment improvements, exceeds the high-rent vacancy threshold (currently set at $2,700), a landlord may deregulate that unit and remove the unit from rent regulation requirements.7 Apartment-years: A measure of how many apartments benefit from tenant protections over a period of time. For example, 5,000 apartments all affordable for a full 20 years would produce 100,000 apartment years of affordability. Because not every apartment will remain affordable for the same amount of time under this agreement, IBO uses this measure to capture the total amount of affordability created over the 20-year regulatory period. |

Detailing the Requirements of the Preservation Regulatory Agreement

Although the regulatory agreement was announced at the time of the sale in October 2015, the deal was actually signed by the new owners of Stuyvesant Town-Peter Cooper Village and HDC in December 2015 and will be in effect through the end of 2035. At all times during the 20-year regulatory period, there must be no fewer than 5,000 “affordable units” in the development. In contrast, many of the other preservation programs under the Housing New York affordable housing plan have a minimum of 30-year regulatory agreements, including a similarly structured but smaller scale preservation deal done at Riverton Square, another MetLife-developed complex located in Harlem.

Because affordability requirements are not linked to specific apartments, however, Stuyvesant Town-Peter Cooper Village’s owners can change which apartments count towards the 5,000 units required to be affordable. Understanding how these affordable units are defined in the regulatory agreement is critical to assessing the impact of the city’s preservation deal. The agreement called on the owners to designate no less than 5,000 apartments as affordable, termed “initial affordable units,” at the time the agreement was signed in December 2015. According to the Housing Development Corporation, in December 2015 there were 5,231 initial affordable apartments with rents to affordable to households with an income at or below 165 percent of area median income; IBO assumes these apartments were all traditionally rent-stabilized units. Despite their selection as initial affordable units, nothing immediately changed for these apartments: they maintained their traditional rent-stabilization status and tenants at the time of the agreement remained as occupants until they chose to move.

As initial affordable units are vacated, the owners must reserve at least 50 percent of the units that turn over as affordable, with the new incoming tenants subject to income restrictions. These income-tested, affordable units are called “future affordable units” in the regulatory agreement. An income-tested unit can be the same apartment as the initially affordable unit that was vacated or it can be swapped for any other vacant apartment in the development. This partial replacement process happens until the total number of affordable units (initial affordable plus future affordable) is reduced to 5,000. After that, every time an initial or future affordable unit becomes vacant, it must be replaced with an income-tested unit so that the total number of affordable apartments never falls below 5,000. The average square footage of apartments designated as affordable must be within 97 percent of the average square footage of all apartments and the owner is expected to use good faith efforts to distribute the affordable units across and within buildings.

In this way, as more initial affordable units turn over, the number of income-tested, future affordable units will increase over the 20-year period of the agreement. Of the income-tested units, 90 percent are to be reserved for households that are middle income, defined by the Department of Housing Preservation and Development (HPD) as no more than 165 percent of the area median income. In 2016, annual income for a household of two could not exceed $119,625 in order for the household to be classified as middle income. The remaining 10 percent of the income-tested units are reserved for households that are low income, defined as 80 percent of area median income. To be classified as low income in 2016, annual income for a household of two could not exceed $58,000.

| Stuyvesant Town-Peter Cooper Village Deal Mirrors Preservation at Riverton Square

Stuyvesant Town-Peter Cooper Village Deal Mirrors Preservation at Riverton Square Affordable housing preservation projects vary widely depending on building needs, with each deal often unique in its structure to address the physical and financial needs of the particular project. While the Stuyvesant Town-Peter Cooper Village preservation deal received a lot of attention due to the unprecedented number of units covered under the regulatory agreement, a very similarly structured deal was made a few months later at Riverton Square. In December 2015, two months after the announcement of the Stuyvesant Town-Peter Cooper Village agreement, the city announced the preservation of Riverton Square in Harlem, another housing complex originally developed by MetLife. The Riverton Square property was also being sold by CWCapital, and as the sale was pending, the new buyers, A&E Real Estate Holdings, agreed to a preservation deal with the city in exchange for property tax breaks valued by the city at approximately $100 million. Under the Riverton Square agreement, 981 units in the 1,229 unit complex are designated as initial affordable units, which will be reduced to 975 units covered under the agreement as units turn over and become income-tested future affordable units. Like at Stuyvesant Town-Peter Cooper Village, many units in the development were already protected under rent stabilization, with 817 units registered as rent stabilized in 2015. As units turn over and become income tested, the affordability levels are to be evenly split among three income tiers: up to 60 percent of AMI, up to 80 percent of AMI, and up to 125 percent of AMI. The Riverton Square deal reaches lower income levels than required in the Stuyvesant Town-Peter Cooper Village deal, although market rates are already lower in Harlem than in the East Village where Stuyvesant Town-Peter Cooper Village is located. The value of the tax benefits given to the Riverton Square owners is slightly less than half that of the Stuyvesant Town-Peter Cooper Village deal, while the number of units covered under the regulatory agreement is less than a fifth of those covered in the earlier Stuyvesant Town-Peter Cooper Village. The Riverton Square agreement is for 30 years, however, while Stuyvesant Town-Peter Cooper Village is only for 20 years, and the income levels for the affordable units at Riverton are set lower. |

Besides being income tested, the rent of a future affordable unit may be subject to a cap. Income-tested units are to be rented at the lower of either the rent-stabilized legal rent (if the unit is rent stabilized) or 30 percent of the income limit for a middle- or low-income family depending on which income tier the unit is reserved. (Recall that affordability is defined as paying no more than 30 percent of household income for housing costs.) If units are rent stabilized and have legal rents below the maximum level deemed affordable for middle- and low-income households, then the agreement will not have any effect on the rent the owners of Stuyvesant Town-Peter Cooper Village can charge. Only when the legal rent for a rent-stabilized unit exceeds 30 percent of the income limit for the apartment is the unit subject to a rent cap under the agreement. Therefore the effect of the regulatory agreement is closely intertwined with the rent-stabilization rules governing Stuyvesant Town-Peter Cooper Village units. The regulatory agreement also includes a step-up provision to limit rent increases for future affordable units in the five years following the end of the agreement in 2035, although these limits depend on the difference between rents of market rate apartments and the rents of affordable units at the end of the agreement.

In addition to the rules governing the 5,000 affordable units, the agreement also limits rent increases for qualifying Roberts units in the five-year period following the expiration of the J-51 tax break in July 2020. Lastly, the agreement requires the new owners to provide an on-site social worker to assist the senior community, a dedicated point person to help seniors apply for a separate city rent freeze program, and social programming designed specifically for seniors. Nearly a third of Stuyvesant Town-Peter Cooper Village households include a resident 65 years of age or older—a share only likely to increase if current residents choose to age in place. While many of the other mechanics of the agreement depend on when current residents move out and what happens to rent-stabilized apartment rent levels over time, the specified senior benefits take effect on day one of the agreement and will remain for the full 20 years of the agreement.

Identifying the Initial Affordable Units. IBO requested that the Housing Development Corporation provide the list of apartments the owners of Stuyvesant Town-Peter Cooper Village designated as initial affordable units under the regulatory agreement. HDC shared the street addresses of the 5,231 initial affordable units, but refused to provide a breakdown of the individual apartments within these buildings, which would have allowed IBO to directly match the agreement to the apartment-level HCR rent-stabilization records. Using HCR data on rents and lease dates, however, IBO has identified 5,246 traditionally stabilized apartments that met the rent limits required for designation as initial affordable units, a difference of 15 units, or 0.3 percent. Because this number is very similar to the number of initial affordable units certified to HDC, IBO can be confident that the units we identified are a close approximation of all of the initial affordable units designated under the agreement.

All of the initial affordable units identified are likely among the traditionally rent-stabilized units that remain in the complex. This is not surprising because rents for the traditionally rent-stabilized units are lower than rents for the Roberts units—apartments that are only in rent stabilization because the property is receiving the J-51 property tax.

Modeling the Impact of the Stuyvesant Town-Peter Cooper Village Regulatory Agreement

Agreement’s Effect Depends on Turnover Rates. Given that units only become subject to income testing when tenants in initial affordable units move out, the number of income-tested affordable units created under the regulatory agreement depends upon the turnover rate of the initial affordable units. Therefore, the first step in assessing the Stuyvesant Town-Peter Cooper Village regulatory agreement was to calculate the turnover rate for traditionally rent-stabilized apartments within the development. Most analyses of rent-stabilized units in New York City focus on the vacancy rate—the share of units that are empty at a particular point in time. In contrast, this analysis depends on the turnover rate, which measures the share of units that changed tenancy within the past year.

Using the HCR rent-regulation data, IBO compared tenant names registered for specific apartments to identify changes in tenancy from one year to the next. (See appendix for details on methodology used by IBO to calculate annual turnover rates). We limited our analysis to the turnover rate of the traditionally rent-stabilized units because the turnover of the initial affordable units is most likely to look similar to turnover of the units with the lowest rents in the past. As noted previously, Robert’s units have a much higher median rent and are therefore more likely to turn over more often than a traditionally rent-stabilized apartment.8

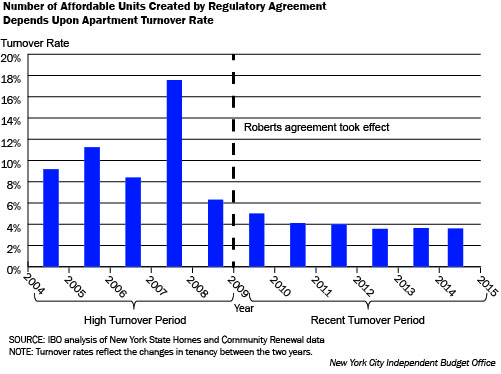

In examining the turnover rates of traditionally rent-stabilized apartments in Stuyvesant Town-Peter Cooper Village, two distinct periods emerged. The first spans 2004 through 2009, the period prior to the Roberts decision, when the average turnover rate for these units was 10.5 percent. It was during this period that there were reports by tenants of aggressive landlord tactics to turn over apartments in an effort to accelerate vacancy deregulation.9 Since the Roberts decision, however, deregulation has no longer been an option and the turnover rate slowed, averaging 4.0 percent from 2009 through 2015. For this report, these are considered the “high” and “recent” turnover rates, respectively. While external factors such as trends in the overall housing market, changes in tenant demographics, or new tenant protection laws (or enforcement of existing laws) at the local or state level likely affect how often apartments change hands, the ownership dynamics within the development appear to have played an outsized role in driving the apartment turnover rate.

Deregulation, Absent the Agreement. When the city preserves affordable housing, it counts all of the units covered under the regulatory agreement towards its affordable housing goal. Preservation deals, however, do not happen in a vacuum, and assessing their impact requires comparing the projected outcome with the agreement to what would occur without it. IBO created models to estimate the impact of the Stuyvesant Town-Peter Cooper Village agreement both in terms of the number of income-tested units it creates and the number of rent-stabilized units it protects that otherwise, absent the city’s intervention, would have been deregulated.

IBO estimates that without any intervention, just under 1,800 apartments would have remained rent-regulated through 2035. Although the de Blasio Administration stated that the regulatory agreement signed in 2015 had the effect of preserving 5,000 units as below-market rate, according to the press release announcing the deal, the city simultaneously had projected that, absent the agreement, 1,500 apartments of those 5,000 would have remained protected under rent stabilization with below-market rents through 2035 anyway, which is only slightly lower than IBO’s estimate. This means that despite the city’s expectation that 1,500 of the 5,000 apartments covered by the deal would have tenant protections in place through rent stabilization for all 20 years, it still counted the full 5,000 units of housing preserved through the deal towards its affordable housing goal.

To create this estimate of traditionally rent-stabilized units over the next 20 years absent the agreement, IBO looked at the extent to which apartments change hands. Under rent stabilization, units that turn over are allowed greater rent increases (known as vacancy increases) than units in which existing tenants simply renew their leases (renewal leases). Vacancy increases are set by law starting at 20 percent of the current rent, but may be adjusted higher or lower depending on when the apartment last turned over and whether the incoming tenant signs a one- or two-year lease.

In order to model rent increases for apartments in Stuyvesant Town-Peter Cooper Village in the absence of the agreement, IBO assumed that when a unit turned over, rent on that unit would increase by 19.6 percent—the average vacancy increase seen during the study period (from 2004 through 2015). In addition to vacancy increases, apartment upgrades (called individual apartment improvements, or IAIs) are often used to boost rents when apartments turn over, particularly in the form of substantial apartment renovations. When a landlord makes capital improvements in an apartment (usually when the apartment is vacant between leases), they can permanently raise the monthly rent by 1/60th of the improvement costs. IBO used data on IAI increases observed during the period of high turnover from 2004 through 2009 to estimate the inflation-adjusted cost of improvements over the next 20 years. In cases where improvements to a vacant apartment would push the legal rent for that unit over the threshold for deregulation, IBO assumed the improvements would be made and the apartment would be deregulated.

For units that did not turn over, IBO assumed that rents would rise by 3.1 percent a year, the average annual rent increase based upon the mix of one- and two-year leases signed at Stuyvesant Town-Peter Cooper Village over the 2004 through 2015 period of the study. Because the Rent Act of 2015 (see sidebar on page 11) now requires the deregulation threshold to move in tandem with the Rent Guidelines Board’s increases in one-year leases, we assumed that the deregulation threshold would rise by 3.2 percent a year, the average one-year lease renewal increase from 2004 through 2015, starting from a base of $2,700 in 2015. (Again, see the Appendix for more details on our methodology.)

| The Rent Act of 2015 Keeps Units in Rent Regulation Longer

Although IBO estimates that, absent the agreement, just under 1,800 rent-stabilized Stuyvesant Town-Peter Cooper Village units would remain regulated in 2035, far fewer units would remain regulated in 2035 if not for a rule change made in the Rent Act of 2015. The act was enacted by the state Legislature in June, several months before the regulatory agreement was reached in October. Prior to the 2015 legislation, the high-rent threshold remained a set amount, adjusted periodically by the legislature since it was introduced in 1997. The Rent Act of 2015 raised the high-rent threshold from a static $2,500 to $2,700, and for the first time, starting in 2016, it tied the threshold to the annual increase in rents for one-year leases set by the Rent Guidelines Board. This means that as long as the legal rent for a unit was below $2,700 in 2015 and tenants choose one-year leases, the high-rent threshold cannot be reached through annual Rent Guidelines Board increases alone. In the absence of this legislation, if the high rent deregulation threshold had remained a constant $2,700 through 2035 and all of the other assumptions in IBO’s model remained the same, only 700 rent-stabilized Stuyvesant Town-Peter Cooper Village units would remain regulated in 2035—1,000 units fewer units by year 20 of the agreement (2035) and 16,000 fewer apartment-years of regulation over the full 20-year period than we projected under the 2015 act that allows for annual increases in the high-rent threshold.10 Completely independent of and preceding the preservation agreement with the city, legislative changes in Albany provided tenant benefits to residents of rent-stabilized units at Stuyvesant Town-Peter Cooper Village and across the city by raising the high rent threshold in years of Rent Guidelines Board increases rents. |

Because rent increases are directly linked to apartments turning over tenancy, in our model of rent increases absent the agreement, IBO used a turnover rate of 10.5 percent a year, the average seen during the high turnover period from 2004 through 2009. Similar to that period, the owners of Stuyvesant Town-Peter Cooper Village would have an incentive to deregulate units through increased turnover in order to maximize rental income after the J-51 tax break, the tax incentive that has kept Roberts units in rent stabilization and that expires in 2020.11 Although protected by the Roberts decision through 2020, the high turnover rate is applied for all 20 years for several reasons. First, it is based upon an average over time that is meant to smooth out potential differences among years. Second there is the possibility that shifts in demographics and market trends could lead to turnover rates that may be higher that were observed historically. Lastly, by doing so, IBO provides the city with the greatest benefit credited to the regulatory agreement when compared with what would happen in its absence.

Using this turnover rate, IBO used simple random sampling without replacement to select which of the 10.5 percent of affordable units would turn over each year. The simple random sample is done without replacement, as once a unit is selected in a given year to be a turnover unit, it cannot be selected again in that year’s sample. Each year’s sample is independent of previous or subsequent years’ sample results, meaning that units may be selected to turnover more than once during the 20-year period. (See Appendix for a detailed description of our modeling methodology.)

As simulating apartment deregulation over the 20-year period involved random sampling of apartments to turn over each year, IBO ran the 20-year model 100 times and averaged the results to minimize the effect of any extremes in the sampling. Each time the model was run, units were removed from our traditionally rent-regulated data set when the unit’s rent was at or above the level high enough to deregulate under current high-rent vacancy rules and the apartment turned over tenancy. We report the average of the results from these 100 simulations.

Apartment-Years and Regulation Without the Agreement. To quantify the impact of the regulatory agreement not just in terms of rent-stabilized units remaining in year 20 of the agreement period (2035), but over the course of the full 20 years (from 2016 through 2035), IBO uses a measure we term “apartment-years.” Not all apartments are covered through rent stabilization for the same length of time, so apartment-years captures not only the total number of apartments that have some form of tenant protection in any given year, but the length of time for which that benefit lasts. This is necessary to measure because—for example, in the absence of the agreement—an apartment that deregulates from rent stabilization in year 19 of the agreement period (2034) has greater value in terms of tenant protections over the course of 20 years than an apartment that deregulates in year 2 of the agreement period (2017). Each year an apartment remains regulated counts as one apartment-year, and so the total number of rent stabilized apartments in each year, added together, collectively measures the level of rent stabilization apartment-years in Stuyvesant Town-Peter Cooper Village across the 20-year period.

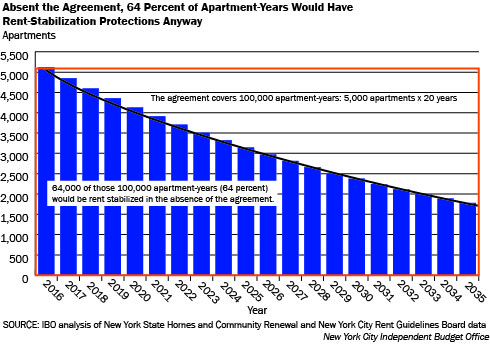

Given when units would deregulate absent the agreement under the high turnover rate assumption (10.5 percent turnover rate, the average seen from 2004 through 2009), our estimate translates to just under 64,000 apartment-years over the next 20 years that would have been protected by rent-stabilization rules without city intervention. (If you sum the number of traditionally rent-stabilized apartments in each year from 2016 through 2035, this results in a total of 64,000 apartment-years.) The agreement that the city put in place could theoretically cover 100,000 apartment-years at most—5,000 apartments preserved over a 20-year period. It follows that 64 percent of the apartment-years the city claimed as preserved by virtue of the regulatory agreement would have had tenant protections and below-market rents in the form of rent stabilization even without the agreement.

As mentioned earlier, rent stabilization, while offering many tenant protections, is not necessarily affordable to the tenants of those units. While the average legal rent for a traditionally rent-stabilized Stuyvesant Town-Peter Cooper Village unit in 2015 was around $1,700, under the model’s assumptions, IBO estimates that the legal rent for a traditionally rent-stabilized unit in 2035 would be around $3,200 absent the agreement. These rent-stabilized units would not be income tested, and although incomes are likely to rise over this period, these apartments may or may not actually be affordable to middle- or low-income tenants.

More Units Remain Rent Stabilized Under Regulatory Agreement. The deregulation of rent-stabilized units depends heavily on turnover rates. Because the new owners must maintain 5,000 units as rent-restricted through 2035 under the agreement, either through rent stabilization or the agreement’s rent caps, this removes the incentive to raise legal rents in order to deregulate units during the regulatory period. By eliminating this incentive, IBO expects that turnover rates will remain in line with the 4.0 percent average turnover rate seen in recent years from 2009 through 2015. Similarly, the development’s owners will have less of an incentive to do major apartment renovations compared with when conversion of apartments to market rate rents is an option, as IBO assumed in the model absent the agreement. This is likely to result in fewer units being renovated and less investment in the complex as a whole. A lower turnover rate and a decrease in the use of IAIs results in fewer units reaching the rent thresholds needed to deregulate.

IBO calculated the deregulation of units under the agreement using a model similar to the one we used to estimate what would happen absent the agreement; however, we use the lower turnover rate and do not apply any IAI increases. Again using simple random selection without replacement, in this model, 4.0 percent of units were chosen to turn over in each year from the sample pool of the 5,000 units covered under the agreement. Units chosen for turnover had the 19.6 percent average vacancy increase applied to the prior year’s legal rent. Units not selected for turnover had the 3.1 percent annualized average renewal increase applied to the prior year’s legal rent, and again the average one-year lease renewal rate of 3.2 percent was applied annually to the deregulation threshold. The model was run 100 times and the results averaged to produce the findings in this report.

Using this model, IBO estimates that, under the agreement, nearly 98,000, or 98 percent, of the 100,000 apartment-years covered by the agreement would be protected under rent-stabilization rules. This is 34,000 more apartment-years of rent regulation than IBO projected in the absence of the preservation agreement. Moreover, the regulatory agreement will also keep the remaining 2,000 apartment-years that have reached rent thresholds high enough to deregulate from actually converting to market rate during the agreement. In this way the regulatory agreement extends rent protections to 36,000 more apartment-years than IBO estimated would have happened just through rent stabilization without the agreement. In other words, IBO’s estimates indicate that the regulatory agreement provides additional protections to 36 percent of the 100,000 apartment-years it covers.

Lower Turnover Rates Mean Fewer Income-Tested Units. Income-tested units (which would not exist without the regulatory agreement) are created when an initial tenant in a traditionally rent-stabilized unit vacates and the unit turns over. Because the regulatory agreement diminishes the incentive to aggressively turn over units, this has the effect of increasing the number of apartments units that remain rent stabilized, which, in turn, constrains the number of income-tested apartments that then are created.

If turnover remains at the current rate (that is, the average observed from 2009 through 2015), IBO estimates that almost 30,000 apartment-years (30 percent of the apartment-years covered by the agreement) will be subject to income testing for new tenants. Every year of the 20-year period, some apartments occupied by the initial tenant will turn over, adding to the number of income-tested units each year. The later into the 20-year regulatory period a unit turns over, however, the less time it will be affordable before the regulatory agreement expires in 2035. For example, by the end of the agreement in 2035, IBO expects 2,700 units would be income tested but only slightly more than 100 of these units would have been income tested since 2016, the first full year the regulatory agreement took effect. Additionally, the number of income-tested units will increase, but at a slowing rate as the development progresses through the 20-year regulatory period, because it is more likely a turnover unit will already be income tested the longer the agreement is in place.

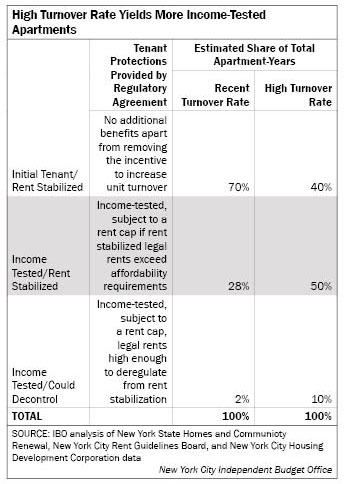

Under the rules of the regulatory agreement, 90 percent of the income-tested subset of units is reserved for middle-income households; the remaining 10 percent are reserved for households that are low income. Therefore, assuming the turnover rate remains at its recent level, 27 percent of apartment-years covered by the agreement would be designated for middle-income households and only 3 percent would be units designated for low-income households. In the remaining 70 percent of apartment-years covered by the agreement, IBO projects that the tenant in residence at the time of the agreement will remain in place.

Interplay of Rent Stabilization and Income Testing. IBO’s models assume that all of the income-tested units designated by the development’s owners will be chosen out of the pool of initial affordable units that turn over. While the landlord is free to choose any unit in the development to replace an initial affordable unit that is vacated, it makes the most economic sense for a profit-maximizing landlord to choose a traditionally rent-stabilized apartment—that is, one of the rent-stabilized units designated as initial affordable units—as these units are already subject to the greatest rent-restrictions through stabilization. This means that some units will have the overlapping status of being both rent stabilized and subject to income testing under the agreement.

IBO estimates that of the 30 percent income-tested apartment-years created under the regulatory agreement, 28 percent of the apartment-years will have an income-tested tenant and also continue to be rent stabilized and only 2 percent of apartment-years would be both income tested and have rents high enough that would allow them to deregulate. For the income-tested units, the regulatory agreement creates the requirement that rents do not exceed levels affordable to the household when they first move into the apartment. Rents, however, are only subject to a rent cap if the unit is not rent stabilized because it has deregulated or, if it is rent stabilized, in instances where the legal rent under rent-stabilization rules becomes unaffordable under the agreement’s definition of affordability: 30 percent of the income limits established for middle- and low-income households. Many of the initial affordable units under the agreement in Stuyvesant Town-Peter Cooper Village had rents far below 30 percent of middle- and low-income household levels in 2015, meaning that it will take a long time for the legal rent under rent stabilization to climb above the 30 percent threshold, in many cases not until after 2035.12

Assuming units continue to turn over at the more recent rate seen from 2009 through 2015, IBO projects that 70 percent of apartment-years will not have an income-tested tenant because the tenant in place at the start of the regulatory agreement will remain in place with rents below the deregulation thresholds; these apartment-years are all covered by rent stabilization, but not income caps. As previously discussed, however, the agreement does remove the incentive for the owners to push for a high turnover rate in an effort to deregulate apartments. Using this slower turnover rate, IBO projects that there will be a net gain of about 6 percent in the total apartment-years that remain rent stabilized relative to what would happen in the absence of the agreement. This 6 percent, along with the 30 percent of apartment-years projected to be income-tested, means that IBO estimates the regulatory agreement provides additional protections to a total of 36 percent of the apartment-years under the affordability agreement.

Rising Turnover Means More Income-Tested Units. IBO expects that the rate at which apartments in Stuyvesant Town-Peter Cooper Village turn over will remain at its recent level of 4.0 percent. It is also possible, however, that shifts in demographics and market trends will lead to changes in turnover rates. For example, if the turnover rate were to increase to the 10.5 percent rate seen in the development from 2004 through 2009, we project that 60 percent of apartment-years would be income tested, with 6 percent of apartment-years reserved for low-income households. Under this high-turnover assumption, an estimated 10 percent of apartment-years would be both income-tested and have rents high enough to allow them to deregulate from rent stabilization.

While changes to the underlying assumptions would alter the share of apartment-years that are income tested, and the number of units that would be in a position to deregulate, the regulatory agreement under neither the high turnover nor the recent turnover rate model provides for income testing in all 5,000 units it covers—not even by year 20—nor would all 5,000 units otherwise be eligible for deregulation, as was suggested at the time the preservation deal was announced.

Protections for Designated Roberts Units Limited by Preferential Rent Rules

Roberts Units and Rent Increase Protections. Beyond its promise to preserve the affordability of 5,000 units, the Stuyvesant Town-Peter Cooper Village agreement also contained language to protect some of the complex’s 5,800 Roberts tenants (those units under rent stabilization only while the development is receiving J-51 tax benefits) from steep rent increases when the benefit expires in 2020. The agreement limits the annual rent increases to 5 percent for five years following the expiration of J-51. These protections, however, could potentially apply to no more than a quarter of the total number of Roberts tenants.

First, the regulatory agreement’s provisions only apply to Roberts units that had been deregulated prior to the court decision and subsequently put back into rent stabilization in 2011, a total of 4,331 units. Second, the protections only apply to units occupied by a tenant continuously from when the apartment was reregistered as stabilized in 2011 through the expiration of the J-51 benefit in 2020—meaning units where the tenant chose to stay in the apartment and pay market rates in the period following its initial deregulation and before the Roberts decision returned the units to rent regulation. IBO estimates that as of 2015, approximately 1,400 units of the 5,800 total Roberts units meet these two criteria. These apartments are described as “designated Roberts units” in the agreement. Should any of the 1,400 designated Roberts units have a change in tenancy from 2015 through 2020, the unit would no longer qualify for the additional protection. Therefore, it is likely that fewer than the 1,400 currently eligible apartments will benefit from this provision.

Preferential Rents and Step Increase Protections. When Roberts units were returned to rent stabilization in 2011, they did not return at the rents at which they left rent stabilization. Instead, a formula created as part of the legal settlement established what the new legal rents would be and—for many units—set new legal rents higher than the actual market rates for those apartments. For this reason, about 65 percent of designated Roberts units are currently renting at preferential rates that are set in line with the actual market rates, an average of $820 less than the legal rent limit. Because designated Roberts units with preferential rents are essentially renting at what the market can bear, any limits the agreement imposes on the legal limit would have no effect on the rent actually charged for the unit, barring any major spikes in the rental market during the five-year protection period. Designated Roberts units without preferential rents—at most, around 490 units—will have annual rent increases capped at 5 percent from 2020 when the J-51 tax break that created the class of Roberts units expires, through the next five years, 2025.

Provisions of the Regulatory Agreement Will Be Difficult to Enforce

Regulatory Agreement Has Limited Oversight. Any regulatory agreement is only as good as how well it is followed and enforced. Under the regulatory agreement signed by the new owners of Stuyvesant Town-Peter Cooper Village and the Housing Development Corporation, however, reporting and oversight requirements are limited. The owners are required to verify that households meet the income and household-size requirements to qualify a tenant to move into an income-tested unit. Twice a year the owners report the following information to HDC: the current rent for any initial affordable units that turned over and became income tested during the past six months; copies of the rental applications (but not of the backup documentation verifying income) for the occupant of affordable apartments that became income tested within the past six months; and a summary of services provided to seniors. The owner does not have to provide information regarding the rent-stabilization status of any of the 5,000 units under the regulatory agreement, and HDC does not receive rent-stabilization data from the state’s Homes and Community Renewal. Beyond the reporting provided to HDC by the development owners, HDC has the right to review full applications and proof of income paperwork, but for no more than 20 income-tested apartments every six months, with the apartments selected by HDC. If material noncompliance is found, additional applications and income documentation may be requested for review by HDC.

| Initial Semiannual Report to HDC Indicates Low Turnover

The owners of Stuyvesant Town-Peter Cooper Village provided HDC with a semiannual report in September 2016 on the income-tested housing created in the first six months since the first lottery for income-tested housing was conducted. HDC provided us with a summary of the information at the building level, but refused to provide apartment-level information that we could match to our apartment-level rent-stabilization data. As of September 2016, the owners reported that 25 units have become income tested as a result of turnover. Of the 25 units, 14 are one-bedroom apartments, 10 two-bedroom apartments, and a three-bedroom apartment. In examining these first 25 income-tested units, HDC has informed IBO that none of the income-tested future affordable units overlap with the 5,231 initial affordable units the owners had listed. This indicates that the owners, for these 25 units, have selected other units from within the complex to be the future affordable units rather than just converting initial affordable units into future affordable units when they become vacant. This may be because delays between when an apartment turned over and the creation of the lottery system and income-verifying process affected which units were vacant at the time new income-tested tenants were approved to move into the complex. Nevertheless, for this analysis IBO relies on the assumption that the future affordable units are created out of initial affordable units for following reasons: 1) the lottery and income verification process are likely to become more streamlined over time, removing the delay between vacancy and move in; 2) the initial report of 25 apartments may be too small to be representative of the project over the long run; and 3) the fact that it is in the economic interest of a profit-maximizing owner to have the affordability restrictions applied to the units that already have the most restrictions, which are the apartments that started as initial affordable units. |

Interplay of Rules Will Make Enforcement Difficult. The regulatory agreement between the city and Stuyvesant Town-Peter Cooper Village is heavily intertwined with state rent-stabilization rules—a system of complex rules on its own. The rent cap for income-tested units only applies if the rent-stabilized legal rent rises above a level deemed affordable, no more than 30 percent of the income levels set for middle- and low-income households. Rent-stabilization rules are monitored and regulated for compliance at the state level, while the regulatory agreement preserving affordable housing at Stuyvesant Town-Peter Cooper Village is at the city level.

Without data sharing and monitoring between the city and state, it would be difficult for the city to determine when the rent cap stipulated in the regulatory agreement would be applicable. HDC has stated it does not have access to any rent-stabilization data and therefore lacks information on which units are traditionally rent stabilized and the legal rents for individual apartments. This is despite the fact that under the regulatory agreement, rents for future affordable units that are regulated must be set at the lower of the rent-stabilized legal rent or the income-based rent. To this end, HDC is relying on the building owner to correctly report rent levels under the agreement, and for tenants to monitor and report any issues with rent stabilization or the preservation agreement to HCR and HDC, respectively.

Enforcement of a regulatory agreement at the city level with the rent-stabilization rules at the state level historically has been problematic for city agencies. For example, a 2015 study by ProPublica revealed that many buildings receiving the city’s 421-a property tax break had not registered their apartments as rent stabilized with the state, a requirement for receiving the 421-a benefits. In addition, although informed tenants are often a valuable resource in ensuring that regulatory agreement rules are followed, the complexity of the Stuyvesant Town-Peter Cooper Village regulatory agreement—particularly how it interacts with the rules for rent-stabilization—may make it difficult for tenants to understand their rights. Moreover, because the 5,000 units covered under the agreement are not tied to specific apartments but can be switched around within the development as units turn over, tenants are not likely to know which units are covered by the regulatory agreement. What may have been an income-tested unit subject to a rent cap under one tenant may be converted to market rate and a different apartment selected to replace the affordable unit. This flexibility may further add to the challenge of relying on tenants to help enforce the regulatory agreement.

Conclusion

The Stuyvesant Town-Peter Cooper Village regulatory agreement signed in October 2015 was the largest single preservation deal in the history of New York City. The tax breaks and loans provided by the city as incentives are valued at a cost of $220 million. The deal was heralded as keeping the rents of 5,000 units below market rate for 20 years, implying the city would preserve 100,000 apartment-years of affordability. Looking closely at the provisions of the regulatory agreement, however, the magnitude of the benefits received by city tenants is less than suggested. In addition, the potential for unlocking air rights at Stuyvesant Town-Peter Cooper Village remains unquantified and its impact on increasing the size of future development is unknown. Although this is not a cost to the city, from the perspective of the owners of the two complexes the sale of air rights may become the most lucrative part of the deal.

In terms of the benefits to city tenants, IBO projects that 64,000 of the apartment-years of affordability the de Blasio Administration attributes to the agreement would have remained rent stabilized even without the deal. Based on this estimate, the regulatory agreement can be credited with preserving 36,000 apartment-years of additional tenant protections (that is, it extends benefits to 36 percent of the 100,000 apartment years covered by the agreement). The number of apartment years of affordability credited to the agreement would have been greater if not for a change in state law that bolstered protections for rent-stabilized units. The Rent Act of 2015, enacted by the state legislature four months before the agreement was signed, allowed for annual increases in the threshold for deregulating high-rent apartments tied to increases set by the Rent Guideline Board for one-year lease renewals. IBO estimates this alone has the effect of providing about 16,000 more apartment-years of rent stabilization benefits to tenants in Stuyvesant Town-Peter Cooper Village from 2016 through 2035 than if the threshold remained at a constant $2,700.

The regulatory agreement provides the additional tenant protections in two ways. First, it removes the incentive for landlords to increase apartment turnover and perform major apartment renovations in order to deregulate units. Therefore, fewer apartments will turn over and deregulate under the regulatory agreement than without it. Second, under the agreement, when one of the 5,000 covered apartments does turn over, it must be replaced by an income-tested affordable apartment. Because IBO estimates that the regulatory agreement will slow the turnover rate at Stuyvesant Town-Peter Cooper Village—which increases the number of rent-stabilized units—it at the same time constrains the number of income-tested units that are created.

IBO estimates that 30 percent of apartment-years covered by the agreement period will be income-tested. The remaining 6 percent of apartment-years that benefit from the agreement receive additional tenant protections because they remain in rent-regulation longer than they would have absent the agreement, but will not become income-tested units because they never turn over tenancy during the regulatory period.

In terms of income-testing, only 3 percent of the 100,000 apartment-years covered by the agreement will be reserved for low-income households and 27 percent of the 100,000 apartment-years covered by the agreement will be reserved for middle-income households. Furthermore, IBO estimates that 28 percent of the total 100,000 apartment-years covered by the agreement would be income tested and still subject to rent stabilization, while only 2 percent would be income-tested and would have rents high enough that would allow them to deregulate, but rents are still held down by the agreement’s rent caps.

Lastly, rent-increase protections for tenants in Roberts units are limited to a small subset of long-term tenants, potentially benefiting fewer than 1,400 households, and even for the subset of Roberts units that do qualify for these rent-increase protections, the mechanics of preferential rents may negate the agreement’s intended protections.

As the Mayor continues to push for the preservation of affordable housing, the subsidies tied to these preservation efforts must be weighed against a realistic estimate of what would happen to the housing in the absence of the city’s intervention. Such a comparison then informs what the public truly gains in exchange for the financing and tax benefits the city provides in enacting the preservation agreements.

Prepared by Sarah Stefanski

Endnotes

1Most affordable housing programs only require income testing upon initial occupancy of an income-restricted unit. Therefore it is possible that should a household’s income go down, the “affordable” rent rate may exceed more than 30 percent of the household’s income and therefore in fact become “unaffordable” to the household living there. Conversely, some income-tested tenants’ incomes may increase during their tenure and therefore enjoy rents that are well below what would be considered affordable. Rent stabilization, however, does not even initially match rents to incomes, and instead, the monthly rent of a unit is set in accordance with state rent stabilization rules.

2For more details on the purchase of Stuyvesant Town-Peter Cooper Village by Tishman Speyer and BlackRock and the ensuing years of ownership, see: Bagli, Charles V. Other People’s Money: Inside the Housing Crisis and the Demise of the Greatest Real Estate Deal Ever Made. New York: Plume, 2013.

3NYC Office of the Mayor, “Mayor, Local Elected Officials and Tenant Leaders Announce 20-Year Agreement with Blackstone and Ivanhoé Cambridge to Protect Middle Class Housing at Stuyvesant Town and Peter Cooper Village,” Press Release, October 20, 2015.

4A copy of the full term sheet can be found on Council Member Daniel Garodnick’s website: http://www.garodnick.com/sites/default/files/NYC-BX%20Term%20Sheet.pdf.

6Details on how future rents were calculated for units returned to rent stabilization through the Roberts agreement can be found at https://www.berdonclaims.com/case_files/Addendum%202%20to%20the%20Notice.pdf.

7Currently awaiting clarification from New York State Homes and Community Renewal is whether a unit that reaches the high-rent deregulation threshold upon vacancy can be deregulated at that point in time, or whether it has to be rented to one last rent-stabilized tenant, and only upon their vacancy can the unit exit rent stabilization. For purpose of our analysis, we assume that when an apartment reaches the high-rent threshold, it will deregulate within that year. This assumption provides the most generous scenario as to how many units the preservation deal will maintain as below-market that, absent the agreement, would otherwise become market-rate units.

8From 2011, when Roberts units were returned to rent stabilization, through 2015, the last year in our study period, IBO found the annual average turnover rate of Roberts units to be 15.8 percent.

9Again, see Bagli, Charles V. Other People’s Money: Inside the Housing Crisis and the Demise of the Greatest Real Estate Deal Ever Made. New York: Plume, 2013.

10This model was also run 100 times and the reported results reflect the average outcome.

11Some might argue that the “high” rate (10.5 percent) should be seen as an upper bound, as tenant protections under rent stabilization have been bolstered since the Tishman Speyer ownership and there may be greater awareness from the tenant association and media regarding aggressive deregulation tactics. Conversely, others might argue that given changes in resident demographics, turnover rates may in fact be pushed higher than 10.5 percent. Given these competing hypotheses, our modeling of the “no agreement” scenario uses the historical “high” turnover rate seen for the development based on the assumption that—absent the regulatory agreement protections—the new owners would pursue deregulation of rent-stabilized units as previous owners had.

12Income caps for the middle- and low-income units are set by the federal government and could increase faster than stabilized rents over the 20-year period, in which case rent stabilized legal rents would always determine the maximum rent the owner can charge.

PDF version available here.

Receive

notification of free reports by e-mail