December 2018

Considering Property Tax Reform:

Will a Lower Target Assessment Ratio Ease Disparate Tax Burdens Among Owners of One- to Three-Family Homes?

PDF version available here.

Summary

Spurred by a lawsuit brought by an unusual alliance of tenant advocates and property owners and the long-simmering public frustration with the city’s property tax system, the Mayor and City Council Speaker have created an advisory commission to recommend potential reforms. But the means for reforming a property tax system mired in complexities and disparities is further complicated by the fact that most changes would require approval in Albany. Making the task even more difficult, the Mayor has also indicated that proposed changes should be revenue neutral, neither substantially increasing nor decreasing collections from the city’s largest tax source.

One part of the property tax system the city does control is the determination of the percentage of a property’s market value that is subject to the property tax. This is known as the assessment ratio. Some policy- and opinion-makers have suggested that lowering the current target of a 6 percent assessment ratio for owners of Tax Class 1 properties—mostly one-, two-, and three-family homes—could ease the wide disparities in tax burdens among these owners. Some Tax Class 1 owners pay an effective tax rate—taxes per $100 of value—that is as much as five times more than other taxpayers. IBO has examined the potential effects of reducing the target assessment ratio below 6 percent, and have found:

- Lowering the target assessment ratio would reduce the tax bills of some but not all Tax Class 1 owners. If the target assessment ratio dropped to 5 percent, roughly a quarter of Tax Class 1 owners would get reductions averaging nearly $500. But the other 75 percent of owners would see their bills rise by an average of about $150.

- Larger decreases in the target ratio would increase the share of “winners,” but the tax bill for “losers” would also rise. A smaller target assessment ratio results in a smaller range over which effective tax rates can vary, but does not eliminate disparities.

- The city lowered the target assessment ratio for Tax Class 1 properties from 8 percent to 6 percent in 2009. But there is scant evidence the change did more than briefly narrow the disparities in tax burdens among these properties.

Much of the difference in tax burdens within Tax Class 1 is caused by a portion of state property tax law that limits the class’s assessment increases to 6 percent a year and 20 percent over five years, which prevents assessed values from keeping pace with market values in fast-appreciating neighborhoods. Lowering the target assessment ratio does little to compensate for this.

Background

With Mayor de Blasio’s and Council Speaker Johnson’s Advisory Commission on Property Tax Reform holding meetings across the city and with a lawsuit brought by an alliance of property owners and tenants known as Tax Equity Now New York (TENNY) proceeding in the courts, the inequities and complexity of New York City’s property tax system are drawing renewed attention. Tax reform discussions usually include an acknowledgement that most changes would require approval by Albany. And while this is true, there are also some steps the city could take on its own that could begin to address some of the problems with the current system. Given the system’s complexity, though, these adjustments could result in other offsetting changes that prove counterproductive.

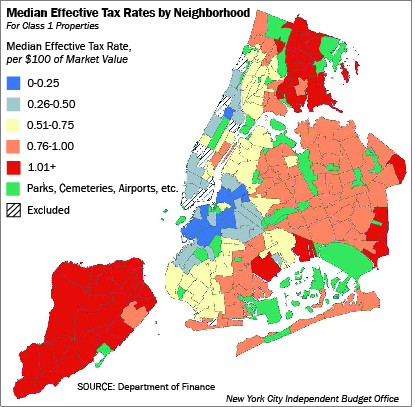

One area where the city’s Commissioner of Finance has authority to act is in setting the assessment ratio—the percentage of a property’s market value that is actually subject to tax—for each of the city’s four property tax classes. It has been suggested that using this lever would be a way of addressing the wide disparities in tax burdens among properties in Tax Class 1, which consists largely of one-, two-, and three-family homes. Some neighborhoods face effective Tax Class 1 tax rates (taxes per $100 of market value) that are five times higher than others. In general, Staten Island neighborhoods have some of the highest effective tax rates, while areas such as brownstone Brooklyn and downtown Manhattan have some of the lowest.

The disparities in Tax Class 1 assessments are primarily due to a feature of the state’s real property tax law limiting the annual increase in a property’s assessed value to no more than 6 percent a year or 20 percent over five years. While the city cannot unilaterally change the limits on annual assessment increases—they are established in state law—it can change the target assessment ratio. (For more explanation of how assessment limits cause disparities in tax burdens, click here.)

A Step the City Could Take on Its Own. At some of the early meetings of the advisory commission and in some of the filings related to the TENNY litigation, it has been suggested that by lowering the target assessment ratio from its current 6 percent that some of the Class 1 disparities could be reduced because there would be a smaller range in which assessment ratios and ultimately effective tax rates could vary. For example, lowering the target ratio to 4 percent would mean assessment ratios could range from just above zero up to 4 percent whereas now they can range up to 6 percent. But as long as the limits on annual assessment increases remain, disparities also would remain between rapid and slow appreciating areas. As experience with previous reductions in the target ratio shows, the beneficial effect diminishes over time.

There also would be winners and losers among Tax Class 1 property owners. If the ratio were reduced unilaterally by the city the higher tax bills for the losers would take effect as soon as the ratio was reduced, without the benefit of any phase-in that would depend on a broader legislative solution enacted in Albany.

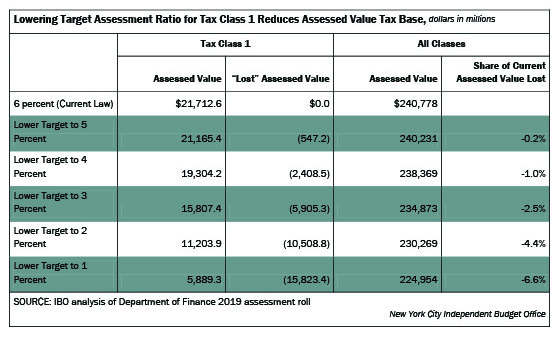

Lower Target Assessment Ratio, Lower Assessed Value. Lowering the target assessment ratio from 6.0 percent to 5.0 percent would remove $547 million of assessed value from the tax base as measured on the 2019 fiscal year assessment roll. The impact of deeper reductions in the target ratio grows rapidly so that a reduction in the ratio to 3.0 percent would result in a loss of $5.9 billion in assessed value, which is 2.5 percent of total assessed value across the city’s four tax classes. A 1.0 percent target ratio would remove $15.8 billion, or 6.6 percent, of the city’s total assessed value from the tax base.

With a smaller tax base, the city would face a choice between raising the overall tax rate in order to generate the same amount of revenue or collecting less revenue from the property tax. The Advisory Commission on Property Tax Reform has been instructed to devise proposals that would not substantially change the city’s current $29 billion in property tax revenue. Because another provision in the state’s property tax law—which cannot be changed unilaterally by the city—limits the shifting of tax burdens among the classes, lowering the Tax Class 1 assessment ratio while maintaining revenue neutrality means the burden of a higher rate would fall entirely on class 1 property owners. Conversely, if the city were to allow tax revenue to fall in response to the loss of assessed value in Tax Class 1 that same feature of the state property tax law would result in a tax reduction for all taxpayers in Tax Classes 2, 3, and 4. But the tax rate for Tax Class 1 would increase, again producing a mix of winners and losers in the class.

Changing the Target Assessment Ratio, Maintaining Revenue Neutrality

The class share feature of the city’s property tax is intended to lock in each class’s share of the tax levy as it stood in 1989, with only small adjustments to reflect some, but not all, of the changes in the share of market value among the classes. Changes in each class’s share of assessed value have no immediate impact on each class’s share of the levy. Thus, lowering the target assessment ratio in Tax Class 1 and removing assessed value from the tax base initially has no effect on Class 1’s share of the property tax levy.2 In this case, lowering the Tax Class 1 target assessment ratio means that the tax rate for Class 1 must be increased to compensate for the loss of assessed value. The overall tax rate would also increase, although there would be no change in the other tax classes. While lowering the target assessed value lowers the tax owed by most taxpayers with assessment ratios that were above the new target assessment ratio, those still below the new target ratio will face higher tax bills.

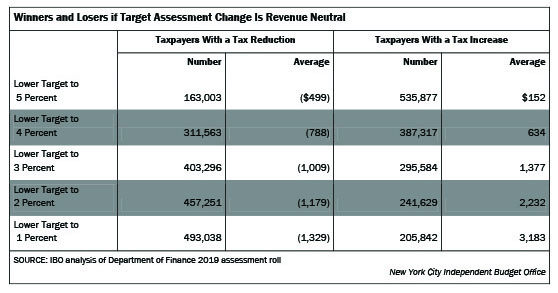

For example, in the current fiscal year, there are approximately 163,000 Tax Class 1 properties with assessment ratios between 5.0 percent and 6.0 percent. Reducing the target ratio to 5.0 percent benefits the owners of these properties and would save them $499, on average. But to compensate for lost assessed value the Class 1 tax rate would need to increase from 20.919 percent to 21.441 percent, and as a result the roughly three-quarters of Tax Class 1 taxpayers with assessment ratios below 5.0 percent would face tax increases averaging $152.

If the target ratio is lowered further, the share of taxpayers receiving tax reductions would grow and those receiving increases would shrink, although the average size of the tax increases would gradually exceed the average size of the decreases. With a 3.0 percent target ratio, more than half of all Tax Class 1 properties (about 403,000 properties) on the current assessment roll would have lower taxes, with an average reduction of $1,009. The losers would have an average increase of $1,377 as the nominal tax rate for Tax Class 1 would be 28.367 percent. With a target ratio of 1.0 percent almost 500,000 properties would have reductions averaging $1,329 this year. But there would still be over 200,000 properties facing average increases of $3,183. The nominal tax rate would reach 71.102 percent.

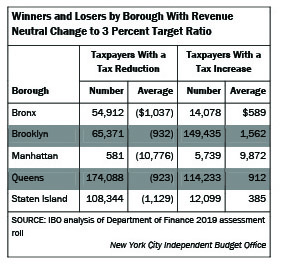

Differences by Borough. Given the wide neighborhood to neighborhood disparities in effective tax rates among Tax Class 1 properties stemming from the differences in assessment ratios, it is not surprising there are differences from borough to borough in the distribution of winners and losers resulting from lowering the target assessment ratio. Consider the effects of a reduction in the target to 3 percent using values from the current assessment roll. In both Manhattan and Brooklyn the majority of properties would have tax increases. There would be decreases for a majority of properties in both Queens and the Bronx, although there would be substantial shares of properties facing tax increases in both. Only in Staten Island would the share of winners approach 100 percent.

If the target assessment ratio was reduced but the revenue neutrality constraint loosened, the distribution of winners and losers would differ, thanks again to the workings of the class share system. (To read more about the class share system, click here.) If the city were to lower the target assessment ratio in Tax Class 1 while maintaining the so-called overall tax rate—which determines the size of the total levy—at the 12.283 percent it has been since 2009, tax revenue based on the 2019 assessment roll would be reduced by $62 million to as much as $1.8 billion, depending on what new target assessment ratio is chosen3. The tax rate in Tax Class 1 would increase, although by less than in the revenue neutral scenario, but in this case there would be decreases in the other tax classes as well. This is because with a lower overall levy but no difference in assessments in the other classes nor in the shares of the levy that each class must bear—recall that the class shares are determined by changes in market value rather than assessed value—the tax rates in Tax Classes 2, 3, and 4 would be slightly reduced to account for the smaller levy.

Using the 2019 assessment roll values, IBO estimates that the total levy would shrink by $62 million if the Tax Class 1 target assessment ratio were lowered from 6 percent to 5 percent while holding the overall tax rate constant. In that scenario, the levy from Tax Class 1 would fall by $5.9 million, accounting for less than 10 percent of the total revenue loss. Tax Classes 2 and 4 would each have levy reductions of about $25 million. If the Tax Class 1 target ratio were lowered to 1 percent its share of the tax savings would grow to about 14 percent, but that would still leave over $1.5 billion of the savings flowing to the other tax classes, which would presumably not be the desired outcome from a change in the Tax Class 1 target ratio.

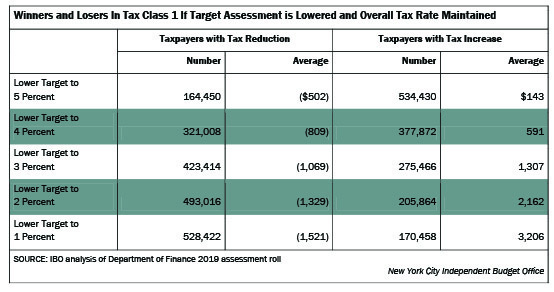

While Tax Class 1 would see an overall reduction in tax levy in a scenario that was not revenue neutral, it would also have a mix of winners and losers within the class. In the other classes all properties would face slightly lower tax liabilities. Lowering the target ratio to 5 percent while holding the overall tax rate constant would result in a $502 tax reduction, on average, for about 164,000 Tax Class 1 taxpayers although another 534,000 would have their tax bill increase by an average of $143. The number of taxpayers getting a reduction would grow as would the average reduction as the target ratio is set at lower levels, but even with a target ratio of 1 percent about 170,000 taxpayers would have an increase averaging $3,206.

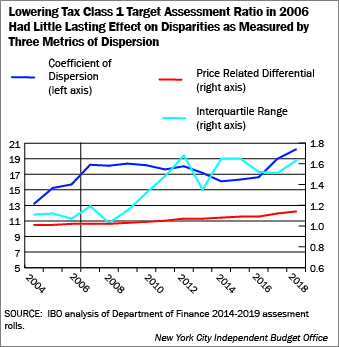

Lowering the target assessment ratio limits the range over which tax burdens can vary. But it does not result in a greater concentration towards the midpoint of the allowable range between just above zero and whatever the new target ratio is set at. Thus, intra-class variation in assessment ratios and eventually tax burdens would remain a problem, with differences still determined by variation in appreciation among neighborhoods. The city last changed the Tax Class 1 target assessment ratio for the 2006 assessment roll when the ratio was lowered from 8 percent to 6 percent. There is little evidence that this 25 percent reduction in the target had more than a brief effect on tax burden disparities within Tax Class 1, at least as measured by three statistics commonly used to evaluate the uniformity of property assessments. The coefficient of dispersion (COD) is a measure of variation in the distribution of a statistic of interest relative to the median—in this case the assessment ratio for each Tax Class 1 property. The larger the COD, the greater the variation in the assessment ratio among Tax Class 1 properties. The COD increased from 2004 to 2005 and again in 2006, although the growth slowed somewhat for the 2006 assessment roll before accelerating again for 2007 and then flattening out beginning in 2008. The CODs remain well above their level in 2005 (and well above the common professional standard of 15) despite having a narrower range to vary over. The interquartile range (IRQ) measures the difference between the 25th and the 75th percentiles of the distribution of the statistic of interest—once again the assessment ratio. If the IRQ grows over time it is an indication of more variation in assessment ratios. The IRQ did fall in 2006, the year the target ratio was lowered but then bounced up again in 2007; it has followed a generally upward trajectory since 2008. The reduction in the extent of variation in assessment ratios following the reduction of the target ratio was short-lived. Finally, we measured the price related differential (PRD), which indicates if dispersion from the mean is greater or smaller for higher-valued properties. The PRD is sometimes referred to as the index of regressivity. A PRD much above 1.0 indicates some regressivity in the distribution. The PRD has trended upward at a steady pace since 2004, when it stood at roughly 1.0. For 2019 it stands at almost 1.14. Lowering the target ratio for 2006 seemingly had no effect on the upward trend either in the short- or long-term. Phasing in the Impact. he scenarios modeled above assume that a lower target ratio would take effect immediately. A large reduction, say from 6 percent to 1 percent would result in very large increases for about 30 percent of Tax Class 1 properties that many would find difficult to bear in a single year. A more modest change such as a 1 percentage point reduction in the target would result in a smaller average increase of $152, albeit paid by about three-quarters of owners, but would do relatively little to reduce the disparities that plague Tax Class 1. With limited ability to create a credit or some other measure or to manipulate the tax rates to mitigate some of the impacts, the city would likely be forced to implement this change gradually over a number of years. A Lasting Fix? Changing the target assessment ratio for Tax Class 1 is one of the few significant levers the city has under its own control. Under the state real property tax law, the Commissioner of Finance has the authority to set the assessment ratio in each class. In the case of Tax Class 1, the ratio functions as a target or maximum as the actual assessment ratio is typically lower given the separate statutory limit on annual assessment increases. It is the limits on annual increases rather than the target ratio itself that produces the wide disparities in tax burdens within Tax Class 1. If the city were to lower the Tax Class 1 target assessment ratio it would bring lower taxes for some but not all Tax Class 1 property owners. If the change were done in isolation and in a way that maintained the same amount of property tax revenue for the city (i.e. revenue neutral) then only Tax Class 1 property owners would be effected. If the change were relatively modest, say lowering the target ratio from 6 percent to 5 percent then only taxpayers with current assessment ratios above 5 percent (roughly a quarter of all Tax Class 1 owners) would get a reduction averaging $499. The other three-quarters would have a tax increase as the Tax Class 1 tax rate would need to increase to overcome the loss of assessed value in the class; their increase would average $152. Larger decreases in the target ratio would increase the share of “winners,” although the average tax increase for “losers” would be greater. If the target ratio were set at 1 percent then roughly 30 percent of taxpayers would face an average increase of $3,183. Among the boroughs, Staten Island would have the highest concentration of winners (90 percent) followed by the Bronx (80 percent). Manhattan, with almost 90 of properties facing tax increases and Brooklyn, with almost 70 percent, would have the largest shares of losers. Lowering the target ratio and accepting some revenue loss would reduce the differences between winners and losers. However, a change that is not revenue neutral would also result in lower tax rates in the other classes. This is because the process for determining each class’s share of the levy and ultimately the tax rate in each class is spelled out in state law and cannot be changed by the city. Thus, some of the tax revenue foregone to address the problem of Tax Class 1 disparities would be absorbed by the other classes instead. There is little evidence that decreasing the target ratio for the 2006 assessment roll spurred a long-term reduction in the extent of disparities. Three different measures commonly used to measure dispersion in property assessments show little lasting improvement. Prepared by George Sweeting Endnotes 1In subsequent years the assesment changes would produce very small changes in tax levy shares. PDF version available

here. Receive

notification of free reports by e-mail

Would a Lower Target Ratio Reduce Disparities Within Tax Class 1?

2Under a nonrevenue neutral scenario, the city could set the tax rate to recover none of the revenue lost to the lower assessment ratio or a portion of it. For simplicity this analysis assumes the city chooses to recover some of the revenue that would be lost by maintaining the current overall tax rate (total tax levy/total billable taxable assessed value) at its current 12.283 percent.