February 2018

Nest Egg:

City’s District Attorneys Holding Millions in

Off-Budget Funds From Asset Forfeitures

PDF version available here.

Summary

Over the past few years, the offices of New York City’s five District Attorneys have garnered millions of dollars through state and federal asset forfeiture laws. These funds flow to the District Attorneys outside of the city’s regular budget process. The Manhattan District Attorney’s office has been the largest beneficiary of asset forfeiture funds, with more than $730 million in hand as of June 30, 2017.

- IBO has examined reports provided by each of the city’s District Attorneys on their federal asset forfeiture funds, which are filed annually with Washington, and obtained additional information from the office of the Manhattan District Attorney on their state funds. The District Attorneys receive these funds to compensate for their assistance on investigations and prosecutions of federal and state crimes and have substantial leeway in deciding how the funds are spent. Settlements with banks including BNP Paribas Bank, HSBC Bank, and Standard Chartered Bank have been the primary source of these “off-budget” funds in recent years. Among our findings: Funds derived from state asset forfeitures and related settlements comprised $512 million of the $734 million held by the Manhattan District Attorney’s office as of June 30, 2017. The state requires minimal annual reporting on how much in state-related asset forfeiture funds have been spent or retained from one year to the next by the District Attorneys.

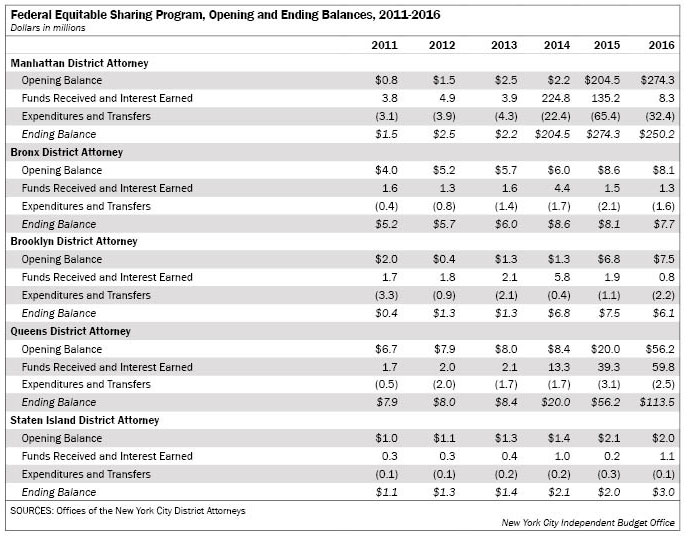

- As of June 30, 2016, the Queens District Attorney held $113.5 million in federal asset forfeiture funds. The District Attorneys of the Bronx, Brooklyn, and Staten Island each had substantially less, from about $3 million to $8 million each. The Manhattan District Attorney had just over $250 million. Much of the Manhattan District Attorney’s spending of federal asset forfeiture dollars in 2015 and 2016 involved the funding of other law enforcement agencies. During those years, the Manhattan District Attorney transferred $35.4 million to other law enforcement agencies, including $20 million to the city’s police department and almost $7 million to the Mayor’s Office of the Criminal Justice Coordinator. Nearly $850,000 went to agencies either elsewhere in New York State or in New Jersey for purposes such as pistol range upgrades and surveillance equipment.

Although there are certain requirements on how asset forfeiture funds are held and spent, the District Attorneys retain considerable discretion over the use these funds. Given that these are essentially public dollars, more transparency and accountability is warranted.

Introduction

Over the past few years substantial sums of money have flowed to the city’s five District Attorneys (DAs), and in particular the Manhattan District Attorney, outside of the standard budget process that funds most city agencies. These funds go directly to the District Attorneys primarily as a result of federal and state asset forfeiture laws. For example, the Manhattan District Attorney reported that as of June 30, 2017 his office had $734 million in funds garnered from asset forfeitures—or nearly six times the office’s annual operating budget appropriated by the city.

Although there are statutory restrictions on how federal and state asset forfeiture funds can be spent, the DAs retain considerable discretion. All of the city’s District Attorneys are required to deposit federal and state asset forfeiture funds retained by their offices in accounts registered with the city’s finance department. In terms of reporting on the funds, the federal government requires that the District Attorneys submit more extensive annual documentation than does the state on how these funds are used.

Given the extraordinary amount of asset forfeiture funds received by his office, Manhattan DA Cyrus Vance created a Criminal Justice Investment Initiative in 2016 to aid in decisions on how to spend $250 million of the state and federal funds. The initiative’s goal is to “improve public safety, develop broad crime prevention efforts, and promote a fair, efficient justice system in New York City.”1

The city’s five District Attorneys—under state law every county in the state, including New York City’s five boroughs (counties) has an elected District Attorney—are responsible for investigating and prosecuting a wide variety of criminal conduct ranging from low level offenses to the most serious crimes. The DAs, and in particular the Manhattan District Attorney, also investigate and prosecute sophisticated economic or so-called “white collar” offenses involving major financial institutions doing business in the city.

Operations of the five New York City District Attorneys’ offices are primarily funded with city revenue but are supplemented with asset forfeiture monies that bypass the city appropriation process. These include federal Equitable Sharing Program funds, which are part of the asset forfeiture program administered by the U.S. Department of Justice and U.S. Department of the Treasury. The District Attorneys also take possession of assets seized under state asset forfeiture laws as well as funds received under deferred prosecution or non-prosecution agreements. The latter are voluntary alternatives to indictment and adjudication in which the prosecution agrees to at least temporarily grant amnesty in exchange for corporations agreeing to fulfill certain requirements, which usually include payments in lieu of fines and forfeitures. Forfeiture initiatives have been criticized by some because assets are often seized prior to prosecution and before guilt has been determined.

Federal Equitable Sharing Program

The Comprehensive Crime Control Act of 1984 authorized federal officials to implement a national asset forfeiture program. According to the justice department, “…asset forfeiture has become one of the most powerful tools for targeting criminals—including drug dealers and white collar criminals—who prey on the vulnerable for financial gain.” Seizing assets from those involved in certain types of crime, “…removes the tools of crime from criminal organizations, deprives wrongdoers of the proceeds of their crimes, recovers property that may be used to compensate victims, and deters crime.”2

The federal government’s program for equitable sharing of proceeds from asset forfeiture initiatives with state and local law enforcement agencies is intended to foster cooperation between the federal government and agencies in other levels of government. Federal law requires that the allocation of funds to state and local law enforcement agencies bear a reasonable relationship to the degree of direct participation of the state or local agency in the law enforcement effort resulting in the forfeiture and takes into account the total value of all property forfeited.

Local prosecutors are eligible to receive funds from liquidated assets as compensation for assistance they provided in federal cases. Eligible assistance includes: helping in the preparation of search and seizure warrants and other documents, providing a key informant or substantially aiding throughout the investigation that leads to a federal forfeiture, lending a state or local attorney to handle the federal forfeiture or related criminal cases in federal court, and prosecuting criminal cases under state law directly related to a federal forfeiture.

Reporting on the Use of Equitable Sharing Funds. Each year District Attorney offices that receive money through the program during the year or that have unspent balances at the end of the year are required to complete an Equitable Sharing Agreement and Certification form. The form documents the funds received that year, the year-end balance, interest earned on undisbursed funds, and details on how these funds were spent. Federal guidelines call for shared monies to be spent as they are received, although these funds may be retained in a holding account for a reasonable period of time—generally no longer than two to three years—to satisfy a future need, such as a capital expenditure.

Undistributed federal equitable sharing funds held by the Manhattan and Queens District Attorneys (and to a lesser extent the Brooklyn District Attorney) increased rapidly in recent years. The Manhattan DA held almost $275 million at the close of 2015, with the increase stemming primarily from cases involving HSBC Bank and Standard Chartered Bank. During 2016 the Manhattan DA’s spending of equitable sharing funds somewhat outpaced the receipt of new funds, resulting in an ending balance of $250 million, down $25 million from the year before—but up $248 million from 2013. Equitable sharing funds on hand at the Queens DA’s office grew to more than $113 million at the close of 2016, nearly 14 times greater than in 2013. The increase was primarily attributable to funds the office received in connection with the HSBC Bank case.

Equitable sharing funds must be used to supplement law enforcement activities and cannot be used to supplant funds from other sources, including local budgets. The federal government outlines permissible uses for equitable sharing funds within the following categories:

Operations and Investigations: Includes support of investigations and operations that further law enforcement goals or missions. For example, payments to informants, purchase of evidence, buy-back programs, reward money (annual dues paid to a crime tip organization or payment for a specific reward for information in a specific case), recruitment and advertisement costs, and translation/interpretation services.

Training and Education: Training of investigators and prosecutors in any area that is necessary to perform official law enforcement duties. For example, training and conference registration fees, speaker fees, or costs to produce a training curriculum.

Facilities: Costs associated with the purchase, lease, construction, expansion, improvement, or operation of law enforcement or detention facilities used or managed by the recipient agency. One example would be the cost of leasing, furnishing, and operating an undercover narcotics facility.

Equipment: Costs associated with the purchase, lease, maintenance, or operation of equipment that supports law enforcement activities. Examples include vehicles, office furniture and supplies, telecommunications equipment, fitness equipment, computers and software, body armor, firearms, and electronic surveillance equipment.

Contracting for Services: Costs associated with contracting for a specific service that supports or enhances law enforcement such as forensic accounting, subject matter experts, and software development.

Travel: Costs associated with travel and transportation in support of law enforcement duties and activities.

Drug and Gang Education Programs: Costs associated with conducting awareness programs by law enforcement agencies. Examples include the costs of meetings, motivational speakers, child identification kits, and anticrime literature or software.

Salary Costs: Although equitable sharing funds generally may not be used to pay the base salaries and benefits of law enforcement or prosecutorial personnel, there are certain limited instances in which such expenditures are allowed. These include when equitable sharing funds are used to pay the matching portion of a federal grant that partially funds state or local law enforcement personnel. Shared funds may also be used to pay the overtime of personnel involved in law enforcement operations.

Transfers to Other Law Enforcement Agencies: Cash transfers of equitable sharing funds from one state or local law enforcement agency to another are allowed although the restrictions on how the funds may be spent remain in place. The agency transferring funds is responsible for verifying that the recipient agency is eligible to receive asset sharing funds. The transfer must be reported by both the transferring and recipient agencies.

Support for Community-Based Programs: A law enforcement agency may, at its discretion, transfer funds to community-based programs with missions that are supportive of law enforcement efforts, policies, or initiatives. Examples include drug-treatment facilities, job-skills training, or programs designed to deter youth from drugs and crime.

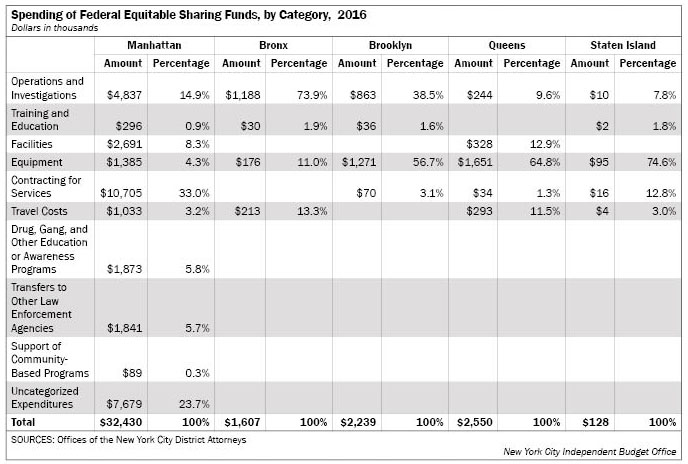

In 2016 the Manhattan District Attorney’s office spent $32.4 million in equitable sharing funds compared with a total of $6.5 million in combined spending by the other four DAs. The single largest category of spending by the Manhattan DA was contracting for services ($10.7 million). The Brooklyn, Queens, and Staten Island DAs each spent the majority of their 2016 equitable sharing funds for equipment, while the Bronx DA spent three-quarters of the funds for operations and investigations.State Asset Forfeiture and Deferred Prosecution Funds

In addition to federal equitable sharing funds, the city’s five District Attorneys also receive funds from assets seized under state forfeiture statutes as well as payments associated with state-sanctioned deferred prosecution agreements. In fact, state asset forfeiture and deferred prosecution funds comprised $512 million of the $734 million in ancillary funds held by the Manhattan District Attorney as of June 30, 2017.3 Nearly $450 million came to the Manhattan DA as part of a settlement reached with BNP Paribas Bank, the largest bank in France. The bank admitted that it violated New York State law by falsifying the records of New York financial institutions. Since 2009 the Manhattan DA also received funds totaling $40 million stemming from deferred prosecution agreements reached with Credit Suisse, Barclays, ING, Commerzbank, and Crédit Agricole.

There are a number of reporting requirements for funds received through state asset forfeiture or deferred prosecution agreements, but they are not as comprehensive as the federal requirements. The District Attorneys must report to the New York State Division of Criminal Justice Services the value of assets seized and funds received under deferred prosecution agreements. The state criminal justice agency then publishes an annual report detailing the total value of assets seized by prosecutors and other law enforcement agencies across the state. The city’s DAs also must deposit all state asset forfeiture funds and payments associated with deferred prosecution agreement into accounts registered with the city’s finance department.

| Focus on the Manhattan District Attorney’s Spending of Federal Funds

Much of the Manhattan DA’s spending of equitable sharing dollars in 2015 and 2016 involved the funding of other law enforcement agencies—inside and outside the city. The majority ($33.6 million) of the spending in 2015 came in the form of transfers to other law enforcement agencies. Most notably $20 million was transferred to the city’s police department for communications-related fiber network enhancements. The Manhattan DA also provided $6.7 million in 2015 to the Mayor’s Office of the Criminal Justice Coordinator for alternatives to incarceration and detention and other initiatives. A total of $4.4 million over the two-year period was transferred to the Brooklyn, Bronx, and Staten Island District Attorneys along with the city’s Special Narcotics Prosecutor. Some transfers were made to agencies outside the city. Over 2015 and 2016 almost $850,000 was transferred by the Manhattan District Attorney to law enforcement agencies either elsewhere in New York State or in New Jersey for purposes such as pistol range upgrades and covert law enforcement equipment. The recipient agencies are among those that the Manhattan DA has collaborated with in joint task forces and the funds transferred are intended to share in covering the cost of projects that benefit all task force members.4 The Manhattan District Attorney provided $1.9 million in 2016 for “drug, gang, and other education awareness programs” to 11 community-based organizations through a competitive bidding process. The Manhattan District Attorney also provided more than $500,000 to the Police Athletic League over the two-year period. From 2011 through 2016 the Police Athletic League received $1.4 million of the federal asset forfeiture proceeds that the Manhattan DA chose to share with community-based programs. This report’s appendix provides greater detail on the Manhattan DA’s spending of federal equitable sharing funds in 2015 and 2016. |

In several important ways, though, the reporting required by Albany from the District Attorneys is not nearly as detailed as the federal equitable sharing reporting requirements. Most notably the DA offices are not required to report to Albany end-of-year balances of their accumulated state asset forfeiture or deferred prosecution agreement funds, interest earned during the year, or details on how much was spent and what it was spent on during the year. Additionally, while the Comptroller includes the funds in the city’s annual financial report, the balances for each DA are reported in aggregate form along with special accounts held by numerous other governmental units.

Criminal Justice Investment Initiative. With a large sum of federal and state asset forfeiture funds in hand, in 2016 the Manhattan DA established a Criminal Justice Investment Initiative and set aside $250 million in forfeiture funds to be used for projects intended to improve public safety while also enhancing fairness within the criminal justice system.

The Manhattan DA selected the City University of New York’s Institute for State and Local Governance through a competitive process to provide technical assistance for the initiative. Applications for criminal justice grants are reviewed both by city university institute staff and the Manhattan DA’s office, with the DA having the final word on spending priorities.

The Manhattan DA’s 2016 Annual Report spelled out a plan to spend a portion of the $250 million to fund the following during 2017:

- Crime Victims’ Services ($11.4 million): To increase crime victims’ access to services, particularly through programs that focus on one or more of the following groups: immigrants; LGBTQ individuals; individuals with disabilities; and men of color.

- College-in-Prison Reentry Program ($7.5 million): An investment in educational programs at New York State prisons to fund more than 2,500 seats for college-level education and training for the incarcerated.

- Social Enterprise Funding ($7.3 million): The District Attorney’s office is funding social enterprises that provide training and career opportunities to young people at high risk of justice-system involvement, as well as formerly incarcerated New Yorkers reentering their communities.

- Support for Youth Aging Out of Foster Care ($5.3 million): Funding for educational, employment, and housing services for young people who are aging out of New York City’s foster care system. According to the Manhattan DA, many young people involved in the foster care system are at increased risk of involvement with the criminal justice system.

Keeping Account

The five District Attorneys have received a sizable amount of funds through asset forfeiture in recent years, dollars allocated to them outside the city’s normal budget process. Although there are certain requirements on how these funds are deposited and spent, the District Attorneys retain considerable discretion over how they use the funds.

Federal guidelines accounting for the use of these funds are more stringent than the state’s, but at least in terms of the Manhattan DA more asset forfeiture funds have recently been received through state asset seizures and deferred prosecution agreements than from federal forfeitures. As of June 30, 2017, the Manhattan DA had more than $500 million in state asset forfeiture funds and more than $220 million in federal funds—information provided at IBO’s request. The state does not require the reporting of forfeiture balances held at the end of the year nor reporting on how money from state forfeitures has been spent. Given that all funds received by the District Attorneys through asset forfeiture are essentially public dollars, more transparency and accountability is warranted.

Prepared by Bernard O'Brien

Endnotes

1About CJII, http://cjii.org/about/

2A Guide to Equitable Sharing for State and Local Law Enforcement Agencies (2009), U.S. Department of Justice, https://www.justice.gov/criminal-afmls/file/794696/download

3Based on email to IBO’s Bernard O’Brien from Pamela Singh of the Manhattan District Attorney’s office, dated August 29, 2017.

4Based on email to IBO’s Bernard O’Brien from Pamela Singh of Manhattan District Attorney’s office, dated November 20, 2017.

PDF version available here.

Receive

notification of free reports by e-mail