Beyond Meal Status: A New Measure for Quantifying Poverty Levels in the

City's Schools

October 2015

Beyond Meal Status:

A New Measure for Quantifying Poverty

Levels in the City Schools

PDF version available

here.

Summary

For many years,

eligibility for free or reduced-price lunch has served

policymakers, researchers, and advocates as the primary means

for quantifying the socioeconomic status of students in the

city’s public schools. But there are a number of concerns about

using meal status as a measure of poverty—from the considerable

number of forms that are incomplete or not returned, to the use

of a 1960s-era nationwide definition of the poverty line that

does not account for New York City’s high cost of living as the

basis of eligibility for free or reduced-price meals.

To address these and

other shortcomings of the meal subsidy approach to quantifying

student poverty, IBO has developed a measure that reflects the

income of a typical household in a particular geographic

community. This approach is not a measure of individual

household incomes of students, but rather a measure of the

incomes in the communities in which students live. We do this

based on the median household income of the census tract where

students reside. This approach can also be used to characterize

a community’s poverty status by comparing the community’s median

income level to a particular income threshold. In this report,

IBO uses the poverty threshold calculated by the NYC Center for

Economic Opportunity—which has developed a well-respected

alternative way to measure poverty in the city—as a benchmark

for our new school community income metric.

This background paper

presents details on the development of our community income

measure and how we ensure the reliability of our indicator. The

paper then applies our measure to school year 2012-2013. Among

our findings:

-

Citywide, the

average student’s community income is about $47,800, with

the community income for about a quarter of students at

roughly $30,900 or less and another quarter at $60,300 or

more.

-

The average

school community income ranges from a low of about $16,440

at P.S. 150 in Brownsville to a high of nearly $168,090 at

P.S. 89 in Tribeca.

-

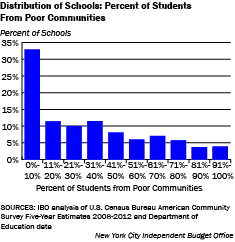

The 7.5 percent

of schools with the largest share of students living in poor

communities serve student populations where between 80

percent and nearly 99 percent of students live in areas

where the community income is below the NYC Center for

Economic Opportunity’s poverty threshold. Conversely,

roughly a third of schools have a student population where

less than 10 percent come from such communities.

While eligibility for

free or reduced-price meals can reflect the income of a

student’s household, that household exists within a broader

community that also affects a student’s identity and school

performance. IBO’s new measure begins to capture that

community’s socioeconomic status.

Introduction

Policymakers and researchers

often analyze the interaction between socioeconomic status and

educational performance. The metric most commonly used relies on a

student’s eligibility for free or reduced-price lunch, a federally

funded program run by the U.S. Department of Agriculture. A student’s

meal subsidy status is treated as a proxy for poverty; that is, if a

student is eligible for free or reduced-price lunch, that student is

considered to be from a low-income household. The meal eligibility

metric measures an individual student’s socioeconomic status, and

reflects that student’s particular household characteristics. But a

student’s household also exists within a broader community—a community

that helps to mold that student’s identity and therefore affects

educational performance. In this paper, IBO introduces one measure that

begins to capture a community’s socioeconomic status using the median

household income of the community as reported by the U.S. Census Bureau.

This paper will be organized

as follows. First, we will review the New York City Department of

Education’s (DOE) process for identifying students who are eligible for

free or reduced-price lunch and our concerns with using meal eligibility

as a measure of poverty. Second, we introduce our new measure of

community income and detail how we ensure reliability for our indicator.

Third, we present three separate distributions of community income in

New York City—a distribution of all households in the census dataset, a

distribution of public school students, and a distribution of public

schools. We also look at how changing the unit of analysis across these

distributions (households to students to schools) changes the

distributions of community income. Finally, we introduce a way to

identify students who come from poor communities and aggregate to the

school level to calculate each school’s share. We compare IBO’s measure

with the widely used measure based on meal eligibility.

Background on the Use of Free or

Reduced-Price Lunch

The process by which a

student’s meal subsidy status is determined is two-fold. First, the DOE

automatically grants students eligibility for free lunch if they are

cross-matched to one of the following lists maintained by the city’s

Human Resources Administration: children in households that receive

public assistance either through Temporary Assistance to Needy Families

or food stamps; children in foster care; children who are migrant,

homeless, or runaway; or children enrolled in Head Start.1

For other students, eligibility is determined by a school meals

application that is submitted by parents or guardians to the school.

Self-reported information on household size and income earned by each

adult living in the household is used to determine if students qualify

for free lunch (household income below 130 percent of the poverty

guideline for that household size) or reduced-price lunch (household

income between 130 percent and 185 percent of the poverty guideline).2

In New York City public schools, the

overwhelming majority of students are classified as poor: roughly 80

percent of students qualify for free or reduced-price lunch.3

There are four main concerns about the use of a student’s meal subsidy

status as a measure of poverty. First, the school lunch eligibility

measure is binary—a student is classified as either “eligible for free

or reduced lunch” or not. It does not allow us to differentiate among

students within those two broad categories. Second, the self-reported

form is an imperfect measure of household income, especially since many

students do not return the form. Students that are deemed ineligible for

subsidized meals due to a missing or incomplete form are assigned to the

full-price lunch status. However, these students tend to perform

academically more like students who qualify for free lunch rather than

students who qualify for-full price lunch based on a completed form.4

Therefore, the group of students considered ineligible for free or

reduced-price lunch may not be as homogenous as it may seem, and may in

fact include many students who would be deemed eligible if proper

documentation was available. Third, many schools are increasingly

participating in federally funded programs to provide free meals to all

students in a school—through the Universal School Meals program or a

similar program for middle schools in the city—regardless of an

individual student’s meal status. As these programs expand, schools have

less of an incentive to collect the forms from each and every student.

The final concern relates to the U.S. Census

Bureau’s definition of the poverty line, which is based on assumptions

from 1963. To determine who is in poverty, the price of a low-cost food

budget, which was designed for different family compositions, is

multiplied by three. This calculation assumes that food generally

accounts for one-third of a family’s expenses, as was the case when the

measure was developed, whereas today food expenditures account for less

than one-seventh of what a family spends.5

Furthermore the measure does not vary geographically or reflect relative

cost of living differentials, which is of particular relevance in New

York City. In 2012, the nationwide poverty line for a family of two

adults and two children was $23,283. Despite these limitations, however,

a student’s meal subsidy status is still the only measure of an

individual student’s socioeconomic status that is generated by the DOE

and therefore the most widely used.

Community Income Measure

For the 2015 edition of

the Education Indicators report, IBO is introducing a measure that is

meant to reflect the income of a typical household in a particular

geographic community as a supplement to the traditional meal

subsidy-based measure of student poverty. It is important to stress that

this is not a measure of the income level of individual families, like

the free or reduced-price eligibility measure, but rather a measure of

income in the community in which students live. IBO’s goal was to create

a measure of income reflective not just of students from the

lowest-income communities in city public schools, but one that can be

used to analyze students at all points along the income distribution,

thereby capturing a student’s relative socioeconomic status. Of course,

this continuous measure can also be used to create any number of binary

measures, such as low-income/not low-income, high-income/not

high-income, or middle income/not middle-income. Therefore, we feel that

this neighborhood-based income measure is more versatile than the

individual measure of poverty that is commonly used.

IBO has created a measure of income based on

the median household income of the census tract where students reside

using data from the U.S. Census Bureau.6

A census tract is a geographic area representing between 1,200 people

and 8,000 people, and optimally covering 4,000 people.7

There are 2,167 census tracts across the city’s five boroughs. In order

to use data at the census tract level, IBO obtained five-year estimates

from the 2012 American Community Survey (ACS), covering data from 2008

through 2012. The ACS produces estimates over one-, three-, and

five-year time spans. Using the five-year estimates allowed us to work

with the largest sample size, the most reliable data, and obtain

precision for small geographic areas, such as the census tract.

Five-year estimates for 2012 include data from surveys sampled each year

from 2008 through 2012.8 The

total sample size was 215,308 housing units over the 5 years,

representing more than 3 million households. For each year, median

household income covers the preceding 12 months and represents pretax

income in 2012 inflation-adjusted dollars. The U.S. Census Bureau caps

the reported median household income for a census tract at $250,000.

One concern with using median household income

data from the ACS is that it is an estimate based on surveys of a

representative sample of the city’s households. Unlike the school meals

application that is distributed to every student, the ACS is

administered only to a representative sample of New York City’s

households. As with all samples, estimates derived from the ACS have an

associated margin of error. The margin of error for the census measure

can be quantified. In order to use only the most reliable ACS data, IBO

has excluded those estimates with large margins of error. There is also

a margin of error associated with city data on meal subsidy status, but

it cannot be quantified because only a portion of school meals

application forms are properly filled out and returned.

IBO balanced the tradeoff between including

the largest possible number of census tracts in our analysis and using

only estimates that we deemed reliable. There were no reported income

estimates for 55 census tracts (2.5 percent of the city’s tracts) in the

original data file because the U.S. Census Bureau considered those

estimates to be unreliable, most likely due to very small sampling

sizes; these census tracts were excluded from our analysis. IBO also

excluded income data from other tracts where the margin of error

exceeded a particular threshold. To do this, IBO calculated the

coefficient of variation (CV), which can be interpreted as the percent

of sampling error associated with an estimate. The CV is calculated from

the published estimates for each census tract and their margins of

error.9 A census tract with a

relatively small CV is a tract with a more reliable estimate of income,

usually reflective of a large sample size. For census tracts where the

median income is capped, the margin of error is missing, and therefore

the CV cannot be calculated. Based on several U.S. Census Bureau

publications, the

American Community Survey User Guide

suggests the following implications for the quality of an estimate based

on CV thresholds: CV less than or equal to 15 percent is considered

good; CV between 15 percent and 30 percent is considered fair; CV

greater than 30 percent is considered poor (to be used with caution).

Although there is no hard-and-fast threshold that is used universally,

IBO excluded income data for those census tracts where the margin of

error was missing or the CV exceeded 30 percent (108 census tracts).10

In all, 163 census tracts were excluded leaving us with reliable income

data from 2,004 census tracts. IBO chose to only present data from this

set of census tracts in this paper and in our

Education Indicators

report.

The distribution for this set of census tracts

weighted by the number of households represented in each tract showed

that the 2012 median household income averaged $58,860, compared with

median household income of about $52,400 for the city as a whole. There

is a large degree of variation in the distribution, with almost $234,000

separating the census tract with the lowest median household income from

the census tract with the highest median household income. Median

household income ranges from $9,700 in a census tract in the

Seagate-Coney Island neighborhood in Brooklyn up to more than $243,000

in a census tract in the Upper East Side-Carnegie Hill neighborhood in

Manhattan. The median household income for a quarter of the city’s

households is roughly $36,800 or below. At the other end of the

spectrum, another quarter of the city’s households live in areas with a

median household income that is more than double that—$75,400 or more.

Identifying Community Income for

Public School Students Citywide and by Borough

Using home addresses

for the city’s 1,100,285 public school students (including students in

charter schools) in the 2012-2013 school year, IBO was able to identify

the 2012 median income of households in each student’s tract of

residence. We refer to this measure as the student’s “community income”

to differentiate it from the traditional measure of poverty derived from

the school meals application forms.11 Of the 1.1 million students, only

148 (0.01 percent) were from census tracts with no reported median

income data. Similarly, relatively few students were from census tracts

with a missing CV or one that exceeded 30 percent (34,649 students, or

3.1 percent of all students). Both groups of students are excluded from

the summaries presented below—leaving 1,065,488 students.

Citywide, the average student’s community income is about $47,800 (see

Table 1, below). The community income for a quarter of the city’s

students is roughly $30,900 or below. At the other end of the spectrum,

another quarter of the city’s students live in areas with a community

income that is almost double that—about $60,300 or more.

At the borough level, while the minimum

student community income in each borough is roughly the same, there is

already a considerable difference by the 25th percentile that persists

throughout the distributions, especially for students in the Bronx. When

ranked by community income, students in the lowest 25 percent of the

distribution in the Bronx, Brooklyn, and Manhattan come from communities

where the income level is at least $14,600 below that of the lowest 25

percent of community income in both Queens and Staten Island. Those

patterns remain the same for the median (50th percentile) of student

community income, with the Bronx, Brooklyn, and Manhattan trailing

Queens and Staten Island; the Bronx lags far behind the other boroughs.

Half of the 243,402 students in the Bronx live in communities with an

income level below $29,200. At the other end of the spectrum, half of

Staten Island’s 66,600 students live in communities with an income level

of $74,900 or above.

Turning to the 75th percentile of the income distribution, students in

the Bronx come from communities with income levels that are nearly

$12,100 lower than in Brooklyn, the next lowest borough. In every

borough except Staten Island, there are big increases in community

income levels between the 50th and 75th percentiles of the distribution

and—as is typically the case in income distributions—the borough’s means

are greater than their medians. Staten Island is unusual in having a

mean student community income below its median. This is due to one

census tract in an industrial neighborhood in West New Brighton (serving

less than 1 percent of the borough’s students) that has a community

income well below the other census tracts on Staten Island, bringing

down the borough’s average.

Looking at the full borough-level

distributions, Manhattan has the greatest intra-borough student

community income variation with the poorest neighborhood located in

Midtown South and the richest neighborhood (excluding those census

tracts whose community income was capped) located on the Upper East

Side. Even excluding the lowest and highest income census tracts within

the borough-level distributions, Manhattan has the largest difference in

community income of the tracts at the 25th and 75th percentiles.

|

Table 1. Distribution of Student Community Income, 2012-2013

|

|

Borough

|

Number of Students

|

Minimum

|

25th Percentile

|

Median

|

75th Percentile

|

Maximum

|

Mean

|

Difference 25th-75th Percentile

|

|

Bronx

|

243,402

|

$13,556

|

$22,404

|

$29,167

|

$40,254

|

$105,682

|

$33,100

|

$17,850

|

|

Brooklyn

|

328,799

|

$9,675

|

$32,210

|

$40,559

|

$52,315

|

$170,481

|

$44,161

|

$20,105

|

|

Manhattan

|

124,865

|

$11,270

|

$27,668

|

$36,236

|

$66,944

|

$243,622

|

$52,006

|

$39,276

|

|

Queens

|

301,827

|

$13,958

|

$46,806

|

$55,399

|

$66,500

|

$137,621

|

$57,094

|

$19,694

|

|

Staten Island

|

66,595

|

$14,413

|

$57,396

|

$74,861

|

$83,226

|

$105,150

|

$69,863

|

$25,830

|

|

Citywide

|

1,065,488

|

$9,675

|

$30,893

|

$43,598

|

$60,263

|

$243,622

|

$47,823

|

$29,370

|

|

SOURCES: IBO analysis of U.S. Census Bureau American Community

Survey Five-Year Estimates 2008-2012 and Department of Education

data

New York City Independent Budget Office

|

Aggregating to the School Level

IBO aggregated across

students in each school to calculate a measure of average school

community income. After identifying the community income for each

student as described above, IBO calculated the school measure as the

average income for the students it served. Those schools missing data

from more than one-fifth of students, either because the student’s

census tract lacked information on the margin of error or because the

tract had a coefficient of variation greater than 30 percent, were

excluded from the analysis. Notably, none of the excluded schools were

high schools, which draw students from across the city and beyond the

school’s physical neighborhood due to the choice process. Finally, we

limit our analysis to schools in districts 1 through 32 that serve

students in grades kindergarten through 12, including charter schools.12

The final sample of schools includes 1,685 schools serving 982,816

students. We report school summaries citywide as well as by the grades

served: high schools and all other schools. Our definition of a high

school is a school that serves any students in any one of the high

school grades—9 through 12.

Citywide, the average school community income

is $44,919 (see Table 2 below). That is roughly $3,000 less than the

average across students, which implies that there is a substantial

concentration of low-income students in many schools. This trend is also

evident when looking at the median school, which has an income level of

$40,559, also about $3,000 less than the median for students. The

average school community income ranges from a low of $16,441 at P.S. 150

in Brownsville in Brooklyn’s district 23 up to high of $168,089 at P.S.

89 in Tribeca in Manhattan’s district 2. The average community income at

Manhattan’s P.S. 89 is more than 10 times the average community income

at Brooklyn’s P.S. 150. A quarter of the city’s schools have a community

income level at or below $33,200; at the other end of the spectrum, a

quarter have an income level at or above $52,600. The difference in

average community income for the school at the 75th percentile and the

school with the highest income is over $115,500, which implies that

there are also some schools with very high concentrations of high-income

students. The difference at the low end of the distribution (between the

minimum and 25th percentile) is a much lower $16,800, or about

one-seventh the difference at the high end.

Contrasting high schools with all other

schools, it is clear that there is significantly less variation among

high schools than there is for other schools, especially when looking at

the top quarter of the distribution. The range in the school average

income level for the school at the 75th percentile and the school with

the greatest income level is much greater for non-high schools (about

$112,000) than for high schools (about $41,000). The difference between

the average community incomes for the schools at the 25th and 75th

percentiles also reflects the greater variation among schools other than

high schools.

|

Table 2. Distribution of Average School Community Income,

2012-2013

|

|

Type

|

Number of Schools

|

Minimum

|

25th Percentile

|

Median

|

75th Percentile

|

Maximum

|

Mean

|

Difference

25th-75th Percentile

|

|

High Schools

|

550

|

$23,289

|

$33,778

|

$39,387

|

$46,542

|

$87,756

|

$41,868

|

$11,490

|

|

All Other Schools

|

1,135

|

$16,441

|

$32,820

|

$41,588

|

$55,760

|

$168,089

|

$46,397

|

$19,441

|

|

Citywide

|

1,685

|

$16,441

|

$33,244

|

$40,559

|

$52,559

|

$168,089

|

$44,919

|

$17,380

|

|

SOURCES: IBO analysis of U.S. Census Bureau American Community

Survey Five-Year Estimates 2008-2012 and Department of Education

data

New York City Independent Budget Office

|

City, Student, and School

Distributions of Community Income

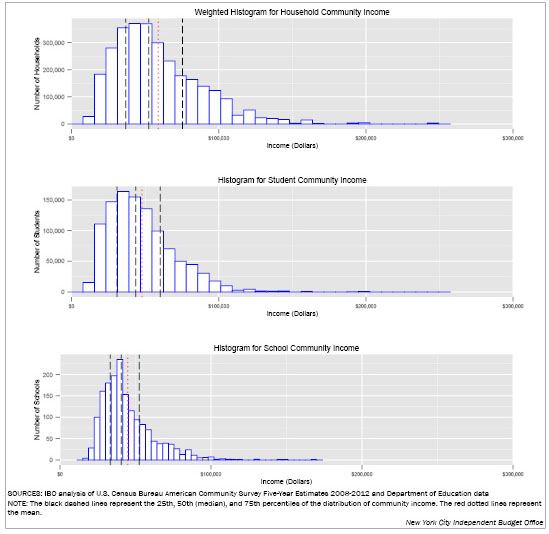

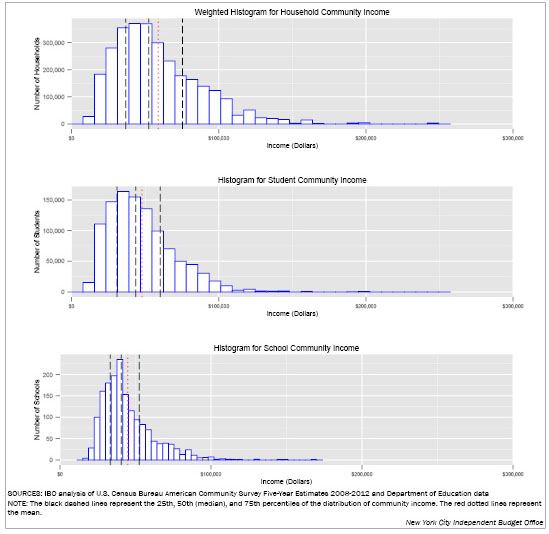

The respective distributions

of community income from all city households, to all New York City

public school students, to all city public schools show that while the

shapes are similar, the peak of the distribution moves slightly more

towards the lower end of the income spectrum as we move from one metric

to the next. All three distributions are right-skewed, which means that

the right side of the distribution extends far from the peak, or mode,

of the distribution. As a result, the median falls above the peak, and

the mean exceeds the median.

Classifying Students Who Come from

Poor Communities

In addition to providing

information about the relative level of community income based on where

a student lives, this measure can also provide an absolute measure of

community poverty by comparing the community’s median income level to a

particular income threshold. As discussed above, IBO felt that the

poverty threshold used by the U.S. Census Bureau does not accurately

reflect the true cost of living in New York City.

Instead of using the

poverty line calculated by the U.S. Census Bureau, IBO chose to use a

poverty threshold calculated by the NYC Center for Economic Opportunity

(CEO), an initiative under the Office of the Mayor. The CEO was launched

by Mayor Michael Bloomberg in 2006. Its mission included an initiative

to develop a more accurate way to measure poverty and count the poor in

New York City. Since August 2008, the CEO has published an annual report

that discusses the methodology behind the CEO-calculated threshold for

poverty and compares conditions in the city using the CEO threshold and

the U.S. Census Bureau’s official threshold. The annual report was

officially mandated in the New York City Charter in December 2013.

The CEO threshold is

calculated based on a five-year moving average of what families spend on

basic necessities, including food, clothing, shelter, and utilities, and

additionally accounts for higher housing costs in New York City.13

The CEO threshold was intended to be used in conjunction with the CEO

income measure, which, in addition to pretax cash income, also includes

the cash-equivalent of in-kind transfers such as food stamps and housing

assistance. The CEO income measure additionally deducts income and

payroll taxes and nondiscretionary spending costs such as commuting,

child care, and out-of-pocket medical expenses. IBO is unable to

replicate CEO’s adjustments to income data and therefore relies on

available median household income data.14

While the size of the median household in a census tract can vary, IBO

chose to use the CEO threshold amount of $31,039 based on a family of

four (two adults and two children) since that composition is widely

used.15 The ratio of the CEO

threshold to the official threshold for that specific family composition

was 1.333 in 2012.

For each of the 982,816 students in the 1,685

schools in our sample, IBO classified a student as coming from a poor

community if the median household income in the census tract where the

student resided was below the CEO threshold. For each school, IBO

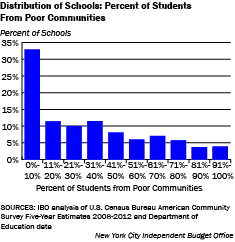

calculated the share of students who come from poor communities. Roughly

a third of schools serve a student population where less than 10 percent

come from poor communities. In another third of schools, from 10 percent

to 40 percent of students come from poor communities. The 7.5 percent of

schools with the largest share of students from poor communities serve

between 80.0 percent and 98.8 percent poor students.

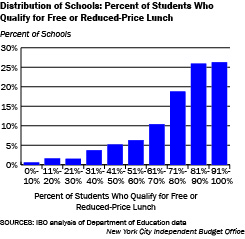

IBO compared the distribution of schools by

this new metric with the distribution of schools by the percent of

students who are eligible for free or reduced-price lunch based on

federal guidelines. There are two key differences in the two measures:

the unit of analysis (census tract versus family) and the treatment of

the threshold for defining poverty. First, the unit of analysis for meal

subsidy eligibility is based on an individual student’s family income

level (taking into account the number of people in the family), whereas

IBO’s metric is based on the median income level of households within

the community where the student resides. By construct, using the median

household income in the community means that only those communities with

a particular concentration of poor households will be classified as

poor. Second, the income measure for meal subsidy eligibility is

multiplied by 1.3 or 1.85 in determining free or reduced-price lunch

eligibility, respectively. Because the guideline is multiplied by a

factor, many city students come from families with reported income below

the guideline. When determining if a community is poor, IBO used the

CEO’s threshold directly when comparing against the median income from

the community. Based on these differences in the construction of the

measures, we would expect that the meal subsidy eligibility measure

would classify many more students as poor—and thus eligible for free or

reduced-price lunch—than IBO’s measure of the percent of students who

come from poor communities.

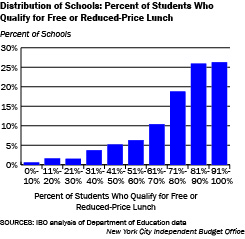

As expected, more than half of the schools

serve a student population where more than 80 percent qualify for free

or reduced-price lunch. Another roughly 20 percent of schools serve from

70 percent to 80 percent of students who qualify. On the other end of

the spectrum, just 3.6 percent of schools have 30 percent or fewer

students who qualify for free or reduced-price lunch. The distribution

of schools using this metric is highly skewed towards the high end of

the distribution—that is, most schools serve very high shares of

students who qualify for free or reduced-price lunch.

While schools tend to be concentrated at one

end of the distribution regardless of which measure of poverty we use,

IBO’s measure of the percent of students from poor communities allows us

to better differentiate among schools because fewer schools are

concentrated at one end. Roughly two-thirds of schools are relatively

evenly distributed in terms of the share of students from poor

communities—ranging from 10 percent up to 98.8 percent. In contrast,

more than 70 percent of schools serve from 70 percent to 100 percent of

students who qualify for free or reduced-price lunch, limiting our

ability to differentiate among schools.

Conclusion

IBO’s measure of community

income can be a useful tool to better assess the income level of

students’ communities citywide and also to better understand the student

populations that individual schools serve. The distribution of student

community income peaks near the low end of the distribution, but there

are also many students who come from relatively high income communities.

Looking at the schools that students attend, we find that there are many

more schools at the lower end of the distribution. This is consistent

with the fact that some elementary and middle schools serve high

concentrations of students from low-income communities because they tend

to be neighborhood schools. IBO also used this measure to identify

students at the lowest end of the community income spectrum in a process

analogous to the determination of a student’s eligibility for free or

reduced-price lunch based on family income. When aggregating to the

school level, we found that about a third of schools serve at most 10

percent of students from poor communities.

Report prepared

by Sarita Subramanian

with Stephanie Kranes

Appendix

IBO chose to report

separately on the schools that span multiple physical locations or cover

whole geographic districts. Those schools include: district 75 schools

serving only students with disabilities, home-schooled students,

universal pre-kindergarten programs in community-based organizations

(CBOs), and district 79 programs serving overage and under-credited

students. District 75 schools and district 79 programs often span

multiple sites. For each school district, DOE aggregates enrollment in

pre-kindergarten in CBOs and home-school designations. The citywide

distribution of community income for those schools is reported below.

District 75 schools serve students with a similar distribution of

community income as with other city schools reported in Table 2. Among

schools that span multiple locations or cover whole geographic

districts, home-schooled students have the largest range in community

income and the highest mean and median community income. District 79

appears to serve the most homogenous group of students in terms of

income out of all the groups reported, and students in these schools

tend to come from relatively poor communities.

|

Distribution of Average School Community Income for Select

Schools, 2012-2013

|

|

Borough

|

Minimum

|

25th Percentile

|

Median

|

75th Percentile

|

Maximum

|

Mean

|

Difference 25th-75th Percentile

|

|

District 75

|

$28,478

|

$35,913

|

$40,822

|

$53,514

|

$72,315

|

$44,608

|

$11,687

|

|

Home School

|

$25,006

|

$40,254

|

$50,460

|

$62,085

|

$105,856

|

$52,298

|

$18,162

|

|

CBO Pre-K

|

$24,206

|

$36,789

|

$44,551

|

$56,339

|

$73,372

|

$46,271

|

$12,636

|

|

District 79

|

$36,918

|

$38,608

|

$40,417

|

$43,166

|

$44,531

|

$40,676

|

$2,830

|

|

Citywide

|

$24,206

|

$36,918

|

$43,091

|

$56,224

|

$105,856

|

$46,650

|

$13,786

|

|

SOURCES: IBO analysis of U.S. Census Bureau American Community

Survey Five-Year Estimates 2008-2012 and Department of Education

data

New York City

Independent Budget Office

|

Endnotes

1Regulation of the Chancellor #A-810,

“Eligibility

for Free and Reduced-Price Meals,” issued June 29, 2009.

2Eligibility for meal subsidy for students in the 2012-2013

school year was determined in August 2012 based on an estimation of the

2012 poverty line, which the U.S. Department of Health and Human

Services calls the “federal poverty guideline.” This is different from

the official poverty line because the guideline uses historical data,

adjusted for inflation since the last official threshold. The

preliminary official poverty line for 2012 was published in January 2013

and finalized in September 2013.

3“New

York City Public School Indicators: Demographics, Resources, Outcomes,”

New York City Independent Budget Office, May 2013.

4See relevant tables in section 4 of “New

York City Public School Indicators: Demographics, Resources, Outcomes,”

New York City Independent Budget Office, 2011.

5“The

Development of the Orshansky Thresholds and Their Subsequent History as

the Official U.S. Poverty Measure,” Gordon M. Fisher, U.S.

Department of Health and Human Services, May 1992 (partially revised

September 1997). More recent

work by the NYC Center for Economic Opportunity has sought to

provide a more accurate threshold for poverty for New York City.

6IBO also considered using income estimates only of (1)

family households and (2) households with children under the age of 18

(school-age children), but the smaller sample size of both of those

estimates led to high margins of error and IBO considered them

unreliable at the census tract level.

7https:www.census.gov/geo/reference/gtc/gtc_ct.html,

accessed 3/31/2015.

8IBO considered using data at the census block group, but

that data is only available for the decennial census and we prefer to

use the most current data possible.

9The U.S. Census Bureau’s presentation on “Things

that May Affect Estimates from the American Community Survey” guided

IBO’s CV calculations. The CV is the standard error divided by the

estimate times 100 (interpreted as a percent). The standard error is

equal to the published margin of error divided by 1.645, because the

margin of error is based on a 90 percent confidence interval for ACS

estimates.

10IBO also tested the sensitivity of this threshold using CV

of 33 percent and 40 percent, but felt that those thresholds allowed for

too much error in the income estimates.

11Students for whom the DOE did not have an address on file

or whose address was outside of the five boroughs were excluded from the

analyses.

12The schools we report on separately in the appendix but

exclude from the main analysis are: district 75 schools serving only

students with disabilities, home schooled students, universal

pre-kindergarten programs in community-based organizations, and district

79 programs serving overage and under credited students. Schools that

had fewer than 20 students were also excluded.

13“The

CEO Poverty Measure, 2005-2012: An Annual Report from the Office of the

Mayor,” NYC Center for Economic Opportunity (CEO), April 2014.

14We acknowledge that in using median household income data,

our measure counts more students as coming from poor communities than

the full CEO methodology would. Therefore, our rates cannot be compared

with the CEO’s published statistics for New York City and its

neighborhoods. However, we still believe that using the CEO threshold is

more accurate than using the official poverty threshold.

15A family size of four (two adults, two children) was chosen

because it is widely used and probably a reasonable assumption for the

census tracts that are included in our study. Because we exclude tracts

with larger CVs, we also likely exclude tracts for which a different

family structure is more prevalent. Additionally, the National Academy

of Sciences found in 1995 that this was the most common structure among

families with children less than 18 years of age. Citro, Constance F.

and Robert T. Michael (eds). Measuring Poverty: A New Approach.

Washington, DC: National Academy Press. 1995.

PDF version available

here.

Receive

notification of free reports by

e-mail

Text Facebook

Twitter

RSS