June 2017

As Hudson Yards Refinances Old Debt:

Need for Nearly $100 Million in Additional Funding Emegres as Costs Continue to Exceed Plan

PDF version available here.

Summary

The Hudson Yards Infrastructure Corporation requires an additional $96 million to cover higher-than-expected costs related to developing the neighborhood on Manhattan’s Far West Side.

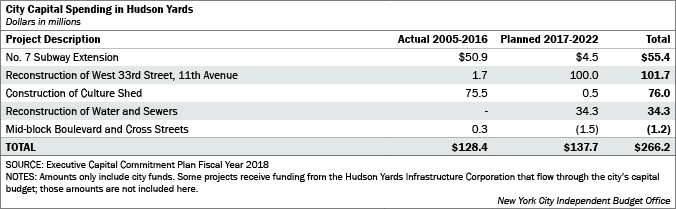

The funding gap comes even after the city provided $128 million from its own capital budget to cover project costs from fiscal years 2005 through 2016 and has another $138 million budgeted over the next five years. The city’s capital costs are in addition to the nearly $360 million the city has spent to subsidize interest costs on the $3 billion in bonds the infrastructure corporation issued to pay for the project.

The Hudson Yards Infrastructure Corporation, a local development corporation created by the Bloomberg Administration in 2005, issued $2 billion in debt in 2007 and $1 billion in 2012 in order to finance the extension of the No. 7 subway line, as well as to make other infrastructure improvements necessary for new commercial and residential development in the neighborhood. The need for additional funding was outlined in documents released by the corporation when it issued $2.1 billion in bonds late last month to refund a portion of its $3 billion in outstanding debt.

Among our findings:

- Depending on how they are financed, some or all of the $96 million in new costs may be borne by the city.

- The recent bond refunding (which is unrelated to the increased funding need) will reduce the Hudson Yards Infrastructure Corporation’s interest payments and begin principal repayment on some, but not all, of the corporation’s current debt in 2018.

- Absent the refunding, the infrastructure corporation would have been obligated under the prior bond agreements to make a principal payment in 2017—marking the first repayment of principal— although subsequent payments would have depended on yearly revenues.

Additional Funding Needed

The Hudson Yards Infrastructure Corporation (HYIC) will require $96 million more than its remaining bond proceeds over the next two years to complete infrastructure improvements for the large commercial and residential project rising on Manhattan’s Far West Side. The need for the additional funds is presented as part of information about the cost of the project contained within the official statement for the refinancing of the project’s existing bonds. Of the additional funding needed, $32 million is attributable to greater-than-anticipated costs for the subway extension and related expenses, and $64 million is associated with the construction of the Hudson Park & Boulevard.

The exact financing method for the additional $96 million is yet to be determined. The bond documents outline three potential options. The excess costs could be funded directly through the city’s capital program, in which case all the costs would be assumed by the city. This option would require City Council approval.

The costs could also be financed as supported completion bonds, similar to the 2007 and 2012 issuances in which the city agreed to subsidize the corporation’s interest payments if project revenue could not fully support the costs. (All years refer to fiscal years unless otherwise noted). In this case, the city could be liable for the interest costs, but not the full $96 million in principal. HYIC has already reached the maximum amount of bonds allowed to be issued as supported bonds, however. The original agreement established that no more than $3 billion in bonds eligible for interest support payments from the city could be issued by HYIC. Therefore, the issuance of $96 million in additional supported completion bonds would require new authorization by the City Council. Lastly, HYIC could also issue unsupported completion bonds, which would have no associated city cost.

Representatives from the Mayor’s Office of Management and Budget declined to comment on which financing option was most likely.

Refunding Reduces Interest Costs

The proceeds from the new bonds issued late last month will be used to refund all $2 billion of HYIC’s 2007 bonds and $391 million of the 2012 bonds.1 The refunded bonds have lower interest costs than the original issuance. Unlike the original issuances, they have a scheduled principal amortization, which sets a plan for principal repayment in addition to interest costs. All $3 billion of HYIC’s original bonds were interest only —meaning HYIC has not yet repaid any of the principal on its 2007 and 2012 issuances.

According to the 2007 and 2012 bond agreements, only after HYIC’s ratio of revenue to debt service met a certain threshold—known as the conversion threshold—would principal repayment according to a specified schedule be required. If the conversion threshold were not met before a certain date (February 2017 for the 2007 bonds and February 2021 for the 2012 bonds) a different plan for repaying principal would be followed: principal payments would only be required in subsequent years in which revenues exceeded the current year’s expenses plus the following year’s projected debt service. In that case the required repayment amount would equal the excess revenue. This alternative plan for principal repayment would be followed until the conversion threshold is met, at which time a specified schedule would be established.

Although HYIC’s revenue has yet to reach the conversion threshold, available funds have recently risen to exceed the level at which HYIC would have been required to make a principal repayment on the 2007 bonds in 2017 under the alternative payment plan.2 As a result of the refunding, however, HYIC will no longer repay any principal in 2017. Similarly, absent the refunding, any repayment of principal in 2018 and beyond would have depended on future revenues because the conversion threshold had not yet been met.

Under the terms of the newly issued bonds, the Hudson Yards Infrastructure Corporation will not begin making principal repayments on the refunded bonds until 2022—essentially granting HYIC a 15-year grace period free of principal payments on the initial 2007 bonds and a 10-year grace period on the refunded portion of the 2012 bonds. However, by including only a portion of the 2012 issuance in the refunding, HYIC expects to reach the conversion threshold on the remainder of the 2012 bonds and thereby be required to establish a fixed schedule for principal repayment of the portion of the 2012 debt that is not being refunded, beginning in 2018.

Due to the refunding, the net present value of the total debt service costs are now lower than what was projected at the time the 2007 and 2012 bonds were issued. Those initial projections assumed principal repayments would begin in 2020 (for 2007 bonds) and 2022 (for 2012 bonds). While debt service costs are now lower than initially projected, it is less clear how they compare with costs had the refunding not taken place. IBO has no way to estimate whether in the absence of the refunding, additional principal repayments would have been required after 2017 because—with conversion threshold not having been met for the 2007 bonds—payments of principal would have depended on annual HYIC revenues, which fluctuate from one year to the next.

Costs Higher Than Originally Estimated

Even before the possibility that an additional $96 million investment would be needed, the Hudson Yards project had already exceeded the original estimated cost to the city. Since 2005, the city has committed $128 million in capital support to fund work associated with the project and has budgeted an additional $138 million to complete those projects over the next five years. Moreover, contributions from the expense budget in the form of interest support payments—subsidies the city agreed to make when the project was approved—have exceeded original estimates.3

City Capital Investment. By 2021, the city expects to have committed $266 million of its own capital funds for work associated with the Hudson Yards development. This includes $55 million for part of the 7-line extension, $102 million for the reconstruction of West 33rd Street, and $76 million for the construction of The Shed (a multidisciplinary art hub) among other projects.

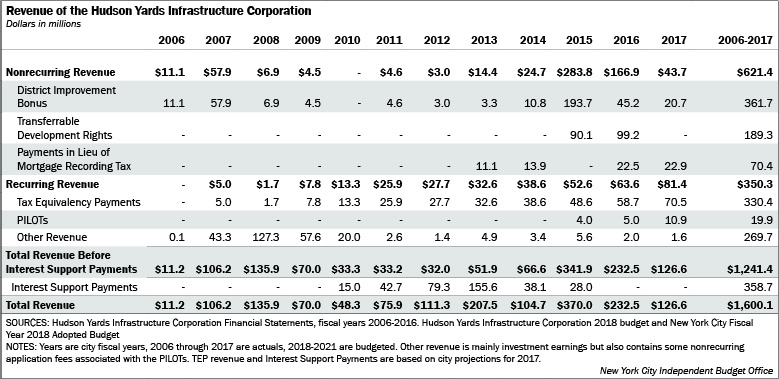

Interest Support Payments. When the Hudson Yards project was approved with a value capture financing strategy, tax revenue and fees generated from the commercial and residential development were projected to increase over time and become sufficient to cover the debt service on the bonds issued to fund the project. However, given that revenues were expected to be lower in the project’s early years, the city committed to pay the difference between interest payments on the supported bonds and revenue generated by the project. To date, the city has paid $359 million in interest support payments. Initial estimates in the feasibility study done by Cushman & Wakefield projected that interest support payments could range from $7.4 million (under the most optimistic scenario) and $205.3 million (under the most conservative scenario).

The Hudson Yards Infrastructure Corporation receives two types of revenues: recurring and nonrecurring. Nonrecurring revenues are one-time revenues resulting from the sale of district improvement bonuses, transferrable development rights (air rights), and payments in lieu of mortgage recording taxes. Recurring revenues come from annual property tax revenue in the form of payments in lieu of taxes (PILOTs) and tax equivalency payments (TEPs).

PILOTs are discounted property tax payments available to certain commercial developments within a specified area in Hudson Yards. PILOTs were originally envisioned solely as a subsidy for the development of office space in the area but have since been used to subsidize retail development, effectively reducing HYIC revenue and increasing the need for city interest support. (See IBO’s 2013 blog post for more details.)

All other new developments that are not eligible for PILOTs under state law—mainly residential and hotel projects—pay their full, not discounted, property taxes to the city. These payments, called TEPs, are then transferred from the city’s general fund to HYIC. (See IBO’s 2013 report for more information on all of these revenue sources).

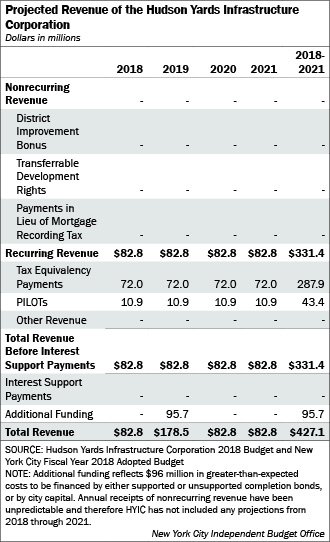

Nonrecurring revenues received by HYIC in 2015 and 2016 were very strong, eliminating the need for city interest support payments through 2019. The city last made an interest support payment in 2015. The 2018 Adopted Budget (approved earlier this month) further eliminated all remaining interest support payments in the financial plan through 2021 ($47 million in previously budgeted subsidies for 2020 and $65 million for 2021). The adopted budget includes $100 million in annual revenues that HYIC will transfer to the city starting in 2018. These funds reflect HYIC’s projected revenues and lower expected debt service costs.

Recurring revenues, while still a small share of HYIC’s overall revenue, have been increasing. Tax equivalency payments grew from $59 million in 2016 to $71 million in 2017 and PILOTs increased from $5 million to $11 million over the same period. As more residential and hotel developments are completed, and as long as commercial buildings continue to be developed, recurring revenues will continue to increase.

The recent revision to the plan for interest support payments likely reflects the better terms achieved with the refunding. It is important to note, however, that these estimates do not incorporate any potential impact on city subsidies if the additional $96 million in costs to develop Hudson Yards are financed using supported completion bonds.

Prepared by Giovanella Quintanilla Re

Endnotes

1In addition to the $2.1 billion in 2017 bond proceeds, $308 million in original issue premium, and $52 million in other HYIC funds were used to pay for the refunding of the $2.3 billion 2007 and 2012 bonds. The additional funds were also used to pay for issuance and other costs associated with the refunding.

2HYIC’s fiscal year 2018 budget released just days before the refunding showed a one-time $127 million repayment of principal scheduled for 2017 with no additional payments scheduled for 2018.

3In testimony to the City Council in 2006, IBO warned that the likelihood of cost overruns was high.

PDF version available here.

Receive notification of free reports by e-mail